The floodlights hit the grass and the hum starts long before the first ball. There is a very specific electricity to an IPL night: the layered drumbeat of a sold-out stadium, the flutter of camera cranes and spidercams, broadcasters cueing in the bowler’s sigh, the bat sponsor held just a fraction longer for that perfect shot. This theatre is also a high-velocity balance sheet, a grand annual declaration of financial intent. The league was built to be powerful entertainment, but it became something even bigger: the most valuable engine in cricket’s global economy.

What follows is the definitive, long-form, no-fluff breakdown of IPL net worth, brand value, media-rights power, team valuations, owner wealth, and the financial architecture that makes the league one of the most efficient money machines in world sport. The focus is ruthlessly practical: clarity in both rupees and dollars, how the money moves, and what really drives club and league valuations. The aim is to be an authoritative hub you can return to whenever you need to understand where the IPL’s value stands, how it is estimated, and why it keeps compounding.

IPL net worth: what the number really means

“IPL net worth” is a shorthand that gets thrown around easily. In finance terms, we usually mean one of three related but distinct measurements:

- Brand value: The intangible value of the IPL brand, calculated by specialist firms using brand royalty or comparable methods. Think of it as the value of the IPL’s name, identity, and the premium it commands across media, sponsorship, and merchandising.

- Enterprise value (EV) of the IPL “business”: The holistic value of the league as a financial asset: media rights, central sponsorships, licensing, and its ability to distribute revenue to franchises and the BCCI. This is more like what investors would consider if they were valuing the entire IPL ecosystem as an enterprise.

- Aggregate franchise enterprise value: The sum of individual franchise enterprise values. This is not the same as league EV, but it is frequently cited to illustrate market depth and capital appetite.

Across the latest cycle, reputable independent estimates place the IPL brand value comfortably above USD ten billion and the broader IPL enterprise value significantly higher. The precise figure depends on method, comparable leagues used, and exchange-rate assumptions. Kroll (formerly Duff & Phelps) and Brand Finance have both chronicled this rise, with the total reflecting an extraordinary combination of media-rights inflation, an elite sponsorship stack, and expansion franchises that reset valuation floors.

Headline snapshot in INR and USD

The following numbers summarize the league’s value and key revenue anchors. Ranges reflect differences across sources and valuation methods.

IPL brand value: approximately USD 10–12 billion (roughly INR 83,000–100,000 crore)

IPL enterprise value: often modeled north of USD 15 billion (roughly INR 125,000–135,000+ crore), depending on assumptions

Media rights, current multi-season cycle (total): around INR 48,000+ crore (roughly USD 6.0–6.5 billion)

Per-match media-rights value: approximately INR 110–120 crore (roughly USD 14–15 million)

Title sponsorship pool: multi-season title deal valued around INR 2,500 crore across five seasons (roughly INR 500 crore per season)

Aggregate central sponsorship pool (non-title): widely estimated in the high hundreds of crores per season, depending on category mix and inventory

Winner’s prize purse: around INR 20 crore, with runners-up and awards taking the total prize outlay well beyond that

These figures aren’t theoretical. They show up in bank accounts across the ecosystem: in BCCI distributions, franchise profit-and-loss statements, and the advertising economy around every over bowled.

How the IPL actually makes its money

Understanding IPL net worth starts with understanding cash flows. The money comes in through a handful of industrial-strength pipes.

Media rights: TV and digital

- Structure: The IPL auctions media rights across television and digital, sometimes in country clusters and with special non-exclusive packages. The current cycle was historic in both total value and the decoupling of TV and digital at scale.

- TV: The broadcast partner pays a per-match rate multiplied across the season. The broadcaster sells ad inventory across pre-match, mid-innings, and in-play overlays, and leverages affiliate distribution and subscription revenue.

- Digital: The streaming partner bids aggressively for exclusive digital rights. CPMs (cost per thousand impressions) surge around marquee matches, with dynamic ad formats and commerce integrations enhancing monetization. Concurrent user records drive premium pricing.

- Result: The TV and digital split has become a story of two strong rivers rather than a single stream. Digital’s rise has redrawn the power map, capturing younger audiences and driving watch-time spikes that traditional TV cannot always match.

Central sponsorships

- Title sponsor: The current title sponsor renewed for multiple seasons at an estimated INR 2,500 crore total value. That sets a benchmark for category pricing and cascades into the broader sponsorship rate card.

- Associate and official partners: Digital payments, consumer tech, fantasy sports, automotive, beverages, telecom, and edtech have all anchored the roster. Central sponsorships are sold on a season-long basis with logo placement on broadcast graphics, stumps, LED perimeters, dugouts, and integrated content.

- Licensing and data: Official data partners, gaming licenses, collectibles, and occasional new IP formats add incremental revenue.

Ticketing and matchday

- Gate receipts: At full capacity, a high-demand venue can gross tens of crores across a season. Aggregated, the league’s total ticketing pot regularly falls in the several-hundred-crore range, varying with schedule density, stadium capacities, and pricing.

- Hospitality and corporate boxes: Premium hospitality is a major ARPU accelerator, particularly at legacy venues with strong corporate demand.

- City-driven activations: Local sponsors often ride the matchday wave with off-site fanzones, branded carnivals, and loyalty clubs that broaden the commercial halo.

Merchandising and licensing

- Jerseys and lifestyle lines: Top teams do brisk business in official kits, special-edition drops, and collabs. The economics rely on scale, strong design cycles, and distribution through both marketplaces and owned channels.

- International sales: NRI-heavy markets contribute to diaspora merchandise demand, especially for the big three brands.

The central pool and how it is split

- Media rights and central sponsorships feed a central revenue pool.

- After production costs and mandated allocations, that pool is split roughly in half between the BCCI and the franchises. Percentages can vary slightly by season and category, but a 50:50 split model is a fair simplification for most readers.

- Franchises also pay certain fees to the BCCI. Expansion franchises, for example, agreed to annual payments linked to their winning bid amounts across their initial operating window.

IPL media rights value: the lever that moves every other number

The single most important driver of IPL valuation is the media rights contract. When that number steps up, everything else steps up with it: franchise distributions, sponsorship CPMs, player salaries, even stadium upgrades.

- Total value: The present multi-season cycle crossed INR 48,000 crore. On a per-season basis, this implies a revenue runway approaching INR 10,000 crore or more just from rights.

- Per match: The per-match value sits in the INR 110–120 crore range, roughly USD 14–15 million, placing the league among the world’s top sports properties on a per-game basis.

- TV vs digital: The digital bid leapt to parity with TV and in some segments surpassed it. That pattern confirms what viewers and advertisers already know: mobile-native, free-to-watch streams can drive mass reach and therefore massive ad revenue, even with aggressive pricing.

Per-game media-rights comparison (ballpark ranges)

- NFL: far higher than any other league globally on a per-game basis

- Premier League: elite, especially when combining domestic and international packages

- IPL: in the same conversation as the biggest football leagues on a per-game basis, and well ahead of most T20 leagues

- NBA: strong but with a different structure and far more inventory

- PSL, BBL, CPL: significantly lower than IPL per game, reflecting market size, advertiser base, and scheduling

These are not direct apples-to-apples comparisons because of different inventory sizes, ad models, and international splits. The conclusion, however, is stable: the IPL monetizes a relatively small number of games at an extraordinary rate, which is the hallmark of elite media assets.

IPL worth in rupees and in USD

- In rupees: The IPL brand is widely valued in the tens of thousands of crores. Conservative readings place it well above INR 80,000 crore, with many models shading higher depending on weighting between brand and enterprise measures.

- In dollars: In USD terms, brand value comfortably to the north of ten billion, with enterprise value estimates above fifteen billion when you include future rights escalators and attach multiples consistent with premium sports properties.

The rupee-dollar conversion is not trivial window dressing. Exchange-rate swings can move headline USD numbers by billions. A robust way to think about it: ground the valuation in INR (because the league earns a dominant share of its cash flows in INR) and translate to USD for global context.

IPL teams valuation: ranking, ranges, and why some clubs pull away

Not all teams in the IPL are equal in market power. Some have long, noisy histories and outsized fan cultures. Others are newer but benefit from expansion scarcity value and strong owners. A practical way to present this is by enterprise value ranges rather than a false precision to the crores.

Indicative franchise enterprise value tiers

-

Market leaders: Mumbai Indians (MI), Chennai Super Kings (CSK)

- Range: often modeled around USD 1.3–1.7 billion each, sometimes higher depending on scenario

- Why: multi-title legacies, huge metro markets, deep sponsor rosters, gigantic digital followings, and the ability to command premium rates for everything from kit space to hospitality. Repeat contenders with strong academies and global feeder ecosystems.

-

Upper tier: Royal Challengers Bengaluru (RCB), Kolkata Knight Riders (KKR), Lucknow Super Giants (LSG), Gujarat Titans (GT)

- Range: commonly placed around USD 1.0–1.4 billion

- Why: RCB and KKR have elite celebrity-fueled engagement and massive pan-India resonance. LSG and GT gained scarcity premiums as expansion teams and rode deep runs and modern operating models to strong commercial starts.

-

Strong core tier: Sunrisers Hyderabad (SRH), Delhi Capitals (DC), Rajasthan Royals (RR), Punjab Kings (PBKS)

- Range: often modeled between USD 0.8–1.1 billion

- Why: SRH and DC are anchored by serious corporate ownerships with reliable sponsor pipelines. RR built smartly with international investment and youth development. PBKS delivers consistent stadium turnout and a wide diaspora following.

Remember: team valuation is not a popularity contest. It is a discounted cash-flow story with a heavy weighting on central distributions, long-term contracts, local revenue growth, and the value-creation discipline of owners.

Brand value of IPL teams

Brand value is different from enterprise value. It isolates the worth of the name, crest, and the psychological premium the brand commands. Specialist reports consistently show:

- CSK: Brand strength off the charts. The Dhoni era built a trust-based brand with city pride and a winning ethos that converts directly into commercial premiums. Engagement intensity drives merch and partner ROI.

- MI: A sleek, corporate brand executed at scale with deep youth pipelines and a polished content engine. Sponsors pay for reliability and reach.

- RCB: A case study in cultural capital. Even when trophies were elusive, the team dominated conversational share and digital engagement, yielding standout sponsor outcomes.

- KKR: Bollywood aura married to sharp cricketing strategy in recent seasons. Strong brand presence across east India and a confident national voice.

- Others: SRH, DC, RR, PBKS, LSG, GT all build nuanced brand positions, some leaning into city identity, others into data-driven cricket, underdog grit, or modernity and swagger.

Owners and ownership: wealth, strategy, and long-term value

The best teams marry financial muscle with operating discipline. Owner net worth can act as a moat because it allows patient investment during downturns and pushes the envelope on facilities and people.

- Mumbai Indians: Owned by a group led by one of the world’s most visible business families. The broader conglomerate has telecom and media assets, synergizing with the franchise’s content distribution and sponsorship gravity.

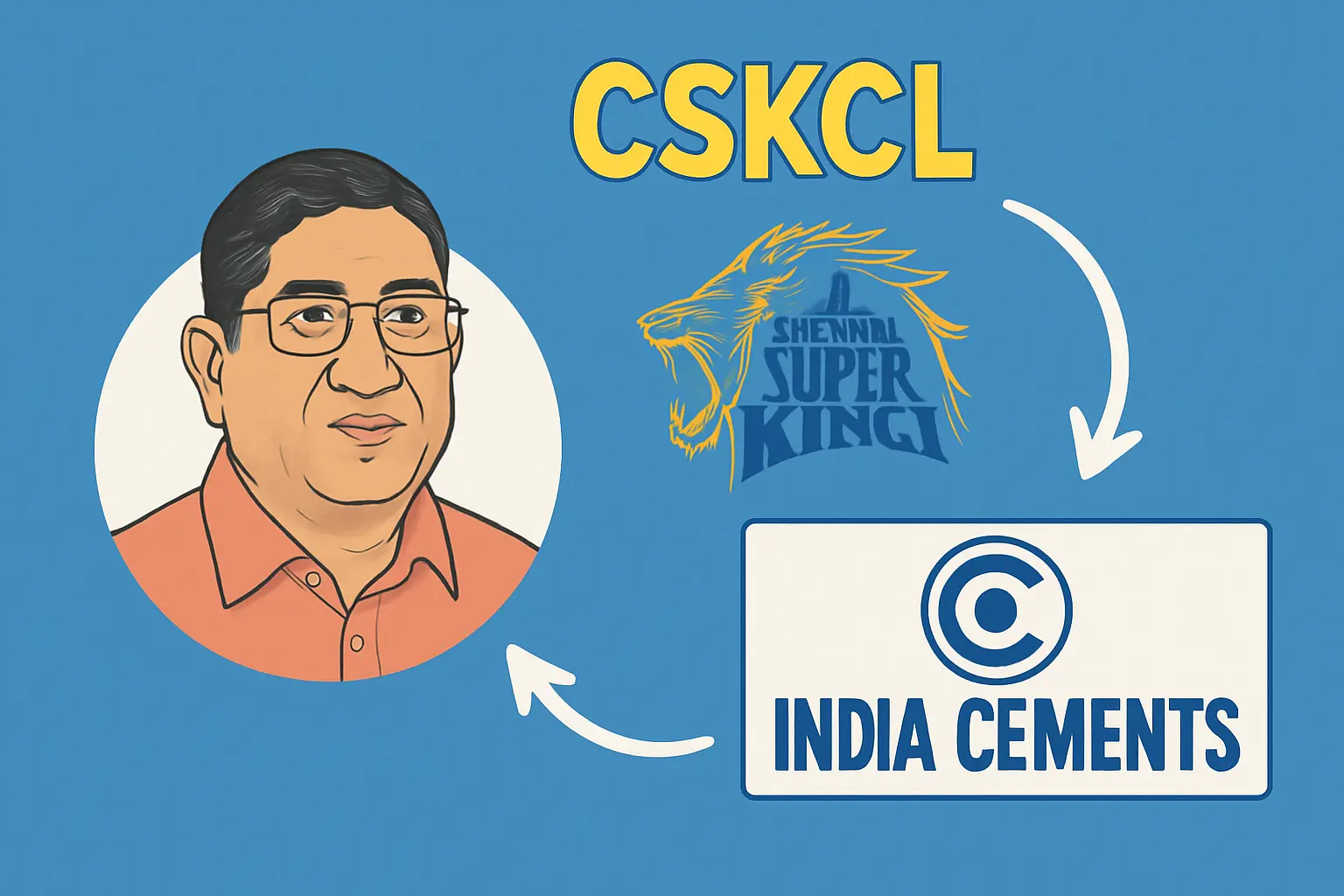

- Chennai Super Kings: Built on a stable cricket-first structure with experienced leadership in the boardroom and the dressing room. The brand outlasts cycles because its culture is codified.

- Kolkata Knight Riders: Co-owned by a global superstar and seasoned investors. A strong multi-team model with international T20 assets, enabling shared scouting, analytics, and commercial leverage.

- Royal Challengers Bengaluru: Corporate ownership with deep consumer-good roots. The brand’s lifestyle pivot into coffee-table culture and city pride paid off handsomely.

- Lucknow Super Giants: An RPSG Group property. High bid signals ambition; the club invested quickly in elite support staff and brand building, monetizing a rabid north Indian market.

- Gujarat Titans: Financial sponsor ownership via a global private equity firm modernized processes and storytelling, translating underdog energy into quick commercial maturity.

- Sunrisers Hyderabad: A media and broadcasting house at the helm brings distribution advantages and stable backing.

- Delhi Capitals: Joint venture between two industrial groups. Co-ownership creates a balanced board with a strong eye on youth development and multi-sport synergies.

- Rajasthan Royals: International investor group with a clear eye on data, academy ecosystems, and high-upside signings.

- Punjab Kings: A storied consortium outfit, with Bollywood and industrial backing, capturing the energy of a massive north Indian fan base.

This matters because valuation depends on repeatability. Owners with long-term capital and operating acumen can lock in compounding effects through scouting, sports science, content IP, and commercial partnerships that span seasons and borders.

BCCI revenue from the IPL

The BCCI’s revenue from the IPL comes principally from:

- Its share of the central media-rights pool (roughly half after costs).

- Central sponsorship income not shared or shared partially with franchises depending on category.

- Franchise fees, including contractual payments from expansion clubs across their initial windows.

- Ancillary licensing and data partnerships.

A typical IPL season delivers thousands of crores to the BCCI from these sources. That cash lubricates the broader Indian cricket pyramid: Ranji Trophy subsidies, women’s cricket, age-group cricket, infrastructure grants, and high-performance programs. The IPL is not just the money-spinner; it is the flywheel that underwrites the domestic game’s velocity.

IPL sponsorship revenue and rate-card dynamics

Sponsorship is the second leg of the stool after media rights. Rate-card dynamics are driven by genuine business outcomes for partners:

- Title sponsor: A five-season commitment around INR 2,500 crore validates long-term brand fit and ROI.

- Central partners: Category exclusivity commands a premium. Fintech, e-commerce, and fantasy sports brands often pay top rupee for association.

- Team-level deals: Sleeve and chest inventory for major teams can clear eight- and nine-figure rupee sums per season. Regional sponsors plug in at more accessible price points.

- Campaign architecture: Modern partners integrate broadcast spots, team-led influencer content, and commerce tie-ins. The result is measurable uplift in brand metrics and sales, which sustains premium pricing despite inflation in rights fees.

Prize money and incentives

The winner’s purse sits around INR 20 crore, with runner-up and playoff teams earning meaningful sums too. Orange Cap, Purple Cap, and other awards add to the pool. In the context of franchise P&Ls, prize money is the cherry rather than the cake, but it matters to fans, players, and the story of the season.

Player wealth, salaries, and the top end of the market

Player compensation is both a product and a driver of IPL valuation.

- Auction dynamics: The league uses a player auction where teams chase scarce roles—powerplay enforcers, middle-overs spinners with elite economy, finishers, or death-bowling aces. In recent auctions, the record hammer price approached INR 25 crore, shattering old ceilings.

- Retentions and right-to-match: Elite retainers command salaries in the high-teens crore, with leadership, marketing weight, and scarcity layered into the number.

- Salary cap and purse: Team purses now sit near the INR 100 crore mark, with periodic uplifts signaled to match media-rights inflation. Some seasons allow mini-auctions; others reset the slate with mega-auctions, creating big-bang repricing.

- Player net worth: The league transforms household names into commercial juggernauts. MS Dhoni, Virat Kohli, and Rohit Sharma sit among the highest-earning athletes in the region, with endorsement income often dwarfing salary. Younger stars break out fast; a single season can turn a domestic talent into a pan-India brand.

- Tax and structure: Players are paid by franchises through structured contracts, with taxes applied as per jurisdiction. Endorsement deals sit in separate entities. For top athletes, the IPL season is an anchor around which they plan international commitments and brand calendars.

How valuation is calculated: IPL methodology in plain English

Most serious attempts at valuing the IPL and its teams rely on three families of methods:

- Revenue multiples: Compare the IPL to other global leagues. Apply a multiple (for example, enterprise value divided by revenue) adjusted for growth, profitability, and market risk. The IPL’s per-game monetization and growth trajectory argue for top-quartile multiples.

- Discounted cash flow (DCF): Project future cash flows—central distributions, sponsorship, ticketing, merchandising—then discount them back at a rate that captures risk. Growth assumptions matter hugely, especially when modeling the next media-rights uplift.

- Brand valuation (royalty relief method): Estimate the notional royalty a business would pay to license the IPL brand. That royalty rate is applied to forecast revenues, capitalized at an appropriate discount rate. This isolates brand power from operating economics.

The best practitioners blend approaches, sanity-check against private transactions, and triangulate with the cost of capital. Reported numbers differ because they answer subtly different questions. Brand value is not the same as enterprise value. Team enterprise value is not the same as league enterprise value. The art is in aligning the method with the decision you need to make.

Historical growth drivers and inflection points

The IPL’s financial story moves through distinct eras:

- Founding era: High-concept, Bollywood-meets-cricket energy; instant sponsor interest; proof of concept that domestic T20 can be appointment entertainment.

- Consolidation: Legacy rivalries form. Fan bases deepen. The league tightens governance, standardizes commercial processes, and expands international broadcasting.

- Shock and resilience: Travel disruptions and neutral-venue seasons stress-test the model. The league proves it can operate in bubbles, protect broadcast output, and keep the cash register ringing. Brand value dips briefly, then rebounds stronger.

- Expansion and streaming supernova: Two new franchises enter on massive bids. The media-rights auction explodes as digital platforms chase reach at all costs. Unit economics shift decisively toward streaming, with free-to-view strategies generating record concurrency and ad inventory.

- Global content play: Franchises extend their brands into other T20 ecosystems. Multi-team ownership becomes the norm, spinning off scouting networks and shared analytics stacks. Valuations compound on the strength of cross-border synergy.

Why the IPL keeps compounding

Several forces keep pushing valuation higher:

- Demographics: A massive, young, mobile-first audience. Live sport cuts through the noise like almost nothing else.

- Scarcity: A relatively small number of matches as compared to football or basketball seasons. Scarcity drives pricing power.

- Culture: The IPL exists at the intersection of sport, cinema, and festival. That makes for potent brand rituals and repeatable commerce.

- Technology: Streaming puts the IPL in every pocket. Personalization and shoppable video unlock new ad products and revenue streams.

- Capital: Owners are well-capitalized and think in decades. That patience breeds better squads, bigger academies, and stronger content ecosystems.

Franchise revenue anatomy: a realistic season P&L

A near-realistic picture for a top-half franchise in a robust market:

Revenue

- Central distribution: Often the single largest line item, representing roughly half of media-rights and portions of central sponsorship after costs. Ballpark: INR 250–350 crore.

- Local sponsorship: From front-of-jersey to official partners and regional deals. Ballpark: INR 75–150 crore depending on brand power and market.

- Ticketing and hospitality: Driven by stadium size, fixtures, and pricing. Ballpark: INR 30–80 crore.

- Merchandising and licensing: Highly variable, often single-digit to low double-digit crores unless a club has cracked lifestyle distribution at scale.

- Other: Academy revenues, content IP, international friendlies, and innovative fan memberships.

Costs

- Player salaries: Up to the salary cap; not all money spent every season depending on bids and retentions.

- Staff and performance: Coaches, analysts, medical, logistics; increasingly professionalized and data-heavy.

- Match operations: Venue rentals, security, production liaison, and fan engagement.

- Marketing and content: Short-form content teams, creator partnerships, and always-on campaigns.

- Franchise fees and taxes: Contractual payments and statutory dues.

Result

Well-run franchises now target healthy positive EBITDA. Margins are not NFL-size but are materially better than the early years when teams chased audience at any cost. The most profitable teams pair strong local revenues with the predictable central distribution and keep fixed costs lean.

IPL vs WPL vs PSL and the global picture

- IPL: The benchmark for cricket properties globally, with per-game media value on par with the world’s elite sports leagues. Team enterprise values regularly crest USD one billion for the most valuable clubs.

- WPL: A courageous and commercially smart launch. Media rights and sponsorship values start at a fraction of the IPL but are on a steep upward curve. The pathway to sustainability is clear: calendar stability, hero storytelling, and grassroots alignment.

- PSL: Runs a tight, competitive product with passionate fan bases. Media and sponsor markets are smaller; per-game valuations reflect that reality. IPL comparisons are flattering but not fair; the PSL’s success should be judged on its own growth vectors.

- Premier League and NFL: The IPL sits behind these giants on total-season revenue but shares their DNA on per-game pricing power and cultural dominance. The broader lesson is that world-class production and domestic love can carry a league across borders.

IPL broadcasting rights price and what it signals

- The headline: The current rights cycle crossed INR 48,000 crore, a number that stunned even bullish observers.

- The signal: Platforms believe in the IPL as a spine for subscriber growth and ad inventory. Rights buyers paid up because they saw clear pathways to monetization: ad rates, commerce, superfan subscriptions, and data-driven targeting.

- The spillover: Production budgets soared. Camera tech, audio capture, and AI-assisted graphics climbed to global best-in-class. The broadcast looks, sounds, and behaves like a premium entertainment product, not just a sports feed.

The richest IPL teams by valuation and brand weight

A valuation list without nuance misleads. With that caveat, a fair reading places MI and CSK at the top, with RCB and KKR close behind. LSG and GT vault into upper tiers due to expansion scarcity and competitive success. SRH and DC sit comfortably, with RR and PBKS anchoring passionate regional markets. The gap between top and middle is not just franchise age; it is content velocity, conversion to commerce, and reliability of on-field performance.

Team-specific highlights

- MI: A dynasty club with global tentacles, from a Caribbean franchise to a South African footprint. Deep bench strength built on scouting, analytics, and elite staff.

- CSK: The house that consistency built. Captaincy continuity, role clarity, and big-match temperament hardened into a mythos that sells tickets and trinkets with equal ease.

- RCB: A digital juggernaut. Fan communities that behave like lifestyle tribes. A brand that transcends results because it has a voice and an identity.

- KKR: A resurgence built on smart recruitment and clarity of roles. Celebrity ownership amplifies every win. Stronghold at Eden Gardens converts into a commercial machine.

- LSG and GT: Proof that modern franchises can be born big if the product and storytelling align. Early playoff runs convert skeptics, and youthful brands resonate online.

Salaries, the cap, and the highest-paid IPL players

- Cap construction: Purses approach INR 100 crore per team. The cap rises in steps that mirror broadcast windfalls, preserving competitive parity while allowing star paydays.

- Top salaries: The record auction buy has pushed to the mid-20s in crores. Elite retentions sit in the high teens. That level compares favorably with elite domestic T20 salaries globally.

- Endorsement flywheel: The real money for megastars often lies outside the cap—in ads, personal brands, and long-term ambassadorships. The IPL season provides the platform; the sponsors pay for fame.

IPL central revenue vs franchise revenue: who gets what

- Central revenues: Media rights and central sponsorships are the gravity well. Once costs are netted out, the franchise share is substantial and predictable.

- Local revenues: Clubs control their own sponsorships, matchday income, and merchandise. The variance here creates the valuation spread between clubs.

- Fees and obligations: Expansion teams commit to significant yearly fees linked to their original bids. All franchises shoulder staff, operations, and tax obligations. The best-run teams compress costs with shared services and outsource smartly.

Ticket revenue per season: the underrated line item

It is easy to overlook gate receipts because media rights are so large. Yet ticketing is crucial for three reasons:

- Margin: A sold-out stadium at well-calibrated price points delivers tidy margins.

- Sponsorship leverage: Full houses sell partners on reach and passion, raising the price of inventory next season.

- Brand experience: Live matchday is where brand love is forged. Fans who attend become repeat customers across categories.

IPL franchise fee structure: what the paperwork looks like

- Legacy franchises: Original contracts included franchise fees across an initial window, followed by a percentage-of-revenue model. Structures evolved as the league matured.

- Expansion franchises: The expansion bids were so large that the winning owners agreed to annual payments pegged to their winning bid amount across a set number of seasons. This structure ensures the BCCI captures expansion value immediately and over time.

Brand value of IPL teams: the intangibles that pay real bills

Several brand factors correlate strongly with valuation and revenue:

- On-field identity: A playing style fans can describe in one sentence.

- Captaincy iconography: A leader whose presence turns moments into mythology.

- City connection: Boroughs and neighborhoods that feel the team is theirs.

- Content velocity: High-quality, daily, creator-led content that feels like a friend, not a broadcast.

- Merch design: Jerseys and streetwear that people actually want to wear three months after the season.

- Purpose: Clear, credible CSR and community programs that compound goodwill.

IPL valuation vs market cycles: why the trend line points up

Media spend cycles wax and wane, but certain properties remain inflation-resistant. The IPL is one of them. It is short, intense, and central to the cultural calendar. Advertisers plan around it. Platforms orient their quarter around it. Fans save for it. In valuations, that reliability commands a premium.

Risk factors to watch

- Advertising softness: Macro slowdowns can suppress ad yields. The defensive hedge is diversified category mix and international monetization.

- Oversaturation: Too much cricket can dampen marginal enthusiasm. The IPL has guarded its scarcity carefully; that discipline must continue.

- Regulatory shifts: Tax policy, gambling advertising, and data rights frameworks can alter revenue streams.

- Player availability: International calendars collide at times. Long-term alignment mechanisms keep the show intact, but it requires constant diplomacy.

How to read conflicting reports about IPL net worth

Different reports answer different questions. A brand valuation report is not trying to estimate enterprise value. A business-news headline might conflate the two. A sensible approach:

- Identify the method: royalty relief vs revenue multiple vs DCF.

- Track the currency: INR vs USD and assumed exchange rates.

- Separate brand value from enterprise value.

- Note whether the number is for the league, a team, or the aggregate across teams.

IPL worth vs fan love: the feedback loop that mints money

Financial value here is not conjured in spreadsheets alone. The IPL throws up unforgettable scripts—super overs, one-handed screamers at midwicket, a veteran finisher dragging a chase with an injured hamstring, a youngster bowling the last over with the courage of a seasoned pro. Those scripts are the raw ore that broadcasters refine and sponsors bottle. The product is emotion. The money follows.

Key takeaways, clean and simple

- IPL net worth in brand terms sits well above USD ten billion; enterprise value models cross USD fifteen billion.

- Media rights are the spine, totalling north of INR 48,000 crore for the current multi-season cycle and valuing each match at roughly INR 110–120 crore.

- BCCI and franchises split central revenue broadly in half after costs, with additional fees and sponsorship flows rounding out the picture.

- Top franchises now clear enterprise values around or above USD one billion, with MI and CSK often leading the pack.

- Player salaries push into the mid-20s in crores at the top end; cap space sits near INR 100 crore per team; prize money for the champion hovers around INR 20 crore.

- The IPL’s per-game monetization compares with the world’s biggest leagues, ranking as cricket’s richest property by a distance.

Appendix: clean tables for quick reference

IPL headline economics (indicative)

| Category | Value (approximate) |

|---|---|

| IPL brand value | USD 10–12 billion (INR 83,000–100,000 crore) |

| IPL enterprise value | USD 15 billion and above (INR 125,000–135,000+ crore) |

| Media rights, current cycle total | INR 48,000+ crore (USD 6.0–6.5 billion) |

| Per-match rights value | INR 110–120 crore (USD 14–15 million) |

| Title sponsor deal | Around INR 2,500 crore across five seasons |

| Winner’s prize purse | About INR 20 crore |

Franchise valuation tiers (indicative ranges)

| Tier | Teams | Enterprise value (USD) |

|---|---|---|

| Market leaders | MI, CSK | ~1.3–1.7 billion |

| Upper tier | RCB, KKR, LSG, GT | ~1.0–1.4 billion |

| Strong core | SRH, DC, RR, PBKS | ~0.8–1.1 billion |

IPL versus other leagues (per-game media value, qualitative)

| League | Per-game rights economics |

|---|---|

| NFL | Highest globally |

| Premier League | Elite, domestic plus international |

| IPL | Among the global top tier on per-game value |

| NBA | Strong, with far more game inventory |

| PSL/WPL | Lower starting base, strong growth trajectories |

Clarity on specific high-interest topics, stated cleanly

- IPL valuation in USD: comfortably above USD ten billion for brand value; enterprise value estimates higher due to multi-season media rights and sponsor escalators.

- IPL worth in rupees: brand value in the tens of thousands of crores; enterprise value north of a lakh crore.

- Richest IPL team: MI and CSK typically top by enterprise value and brand strength, with RCB and KKR close.

- IPL teams valuation: most franchises now valued in the USD one-billion neighborhood or higher, with ranges as noted in tiers above.

- BCCI revenue from IPL: a large, predictable share of the central pool each season plus sponsorship and fees; total intake runs into thousands of crores.

- IPL prize money: the champion’s cheque is around INR 20 crore, with other awards and placements adding significant sums.

- Highest-paid IPL players: record auction fee near INR 25 crore, elite retainers in the high teens, with endorsement income on top.

- IPL media rights value: current multi-season total exceeds INR 48,000 crore; per match approximately INR 110–120 crore.

- Brand value of IPL teams: CSK, MI, and RCB generally dominate, driven by performance, personality, and social capital.

What to expect next in the IPL valuation arc

- Digital premium continues: Streaming-led models with commerce integrations, superfan subscriptions, and targeted ads pushing yields higher.

- International monetization: Deeper licensing in global markets with high NRI density and time-zone friendly windows for key fixtures.

- Venue upgrades: Stadium modernization and hospitality expansion to grow matchday ARPU and corporate sales.

- Data and personalization: AI-assisted highlights, multi-angle streams, and player-tracking layers turning viewership into engagement and engagement into monetizable micro-moments.

- Multi-team ownership synergies: Shared scouting, analytics, and talent development compounding competitive advantages and stabilizing costs.

A closing thought from the other side of the boundary rope

Stand at the rope when a chase reaches its final over and the math is pure adrenaline: runs needed, balls left, fielders shifting. That tension is the essence of sport. The IPL took that essence and made it a national ritual, a guaranteed block in calendars, a rhythm of the summer. The money rushed in because the moments were irresistible, and because the league learned to sell those moments with world-class craft.

IPL net worth, whether expressed in rupees or dollars, brand value or enterprise value, is ultimately a measure of belief—sponsors believing in reach, broadcasters believing in habit, fans believing that tonight might be unforgettable. The balance sheet is only a reflection of that belief. In the IPL, belief seems to renew itself every time the lights come on.

Zahir, the prolific author behind the cricket match predictions blog on our article site, is a seasoned cricket enthusiast and a seasoned sports analyst with an unwavering passion for the game. With a deep understanding of cricketing statistics, player dynamics, and match strategies, Zahir has honed his expertise over years of following the sport closely.

His insightful articles are not only a testament to his knowledge but also a valuable resource for cricket fans and bettors seeking informed predictions and analysis. Zahir’s commitment to delivering accurate forecasts and engaging content makes him an indispensable contributor to our platform, keeping readers well informed and entertained throughout the cricketing season.