Updated: This season

Change log:

- Expanded stake and corporate entity details per team

- Added WPL owners and cross-league mapping

- Clarified “who owns IPL” vs “who owns a franchise”

- Refreshed FAQs, including Hinglish queries

There’s a glamorous story on camera and a grittier one off it. In the middle sit the IPL team owners—some are global conglomerates, some are family-run empires; a few are celebrities who turned their brand into a sports business; others are private equity investors with a cold eye for returns. The distinction matters. Often the person you see on the podium isn’t the legal owner. The company behind the badge is the entity that pays the bills, signs the sponsorships, and negotiates stadium deals. The person is the public face.

This guide goes far deeper than a roll call. If you care about who really owns each team, what those companies do, how the stakes have shifted, why some owners are in multiple leagues, and how the money flows, you’re in the right place. Let’s start with a clean snapshot, then get into the nuance, team by team, and finally tie it all together with valuations, the WPL crossover, and detailed FAQs.

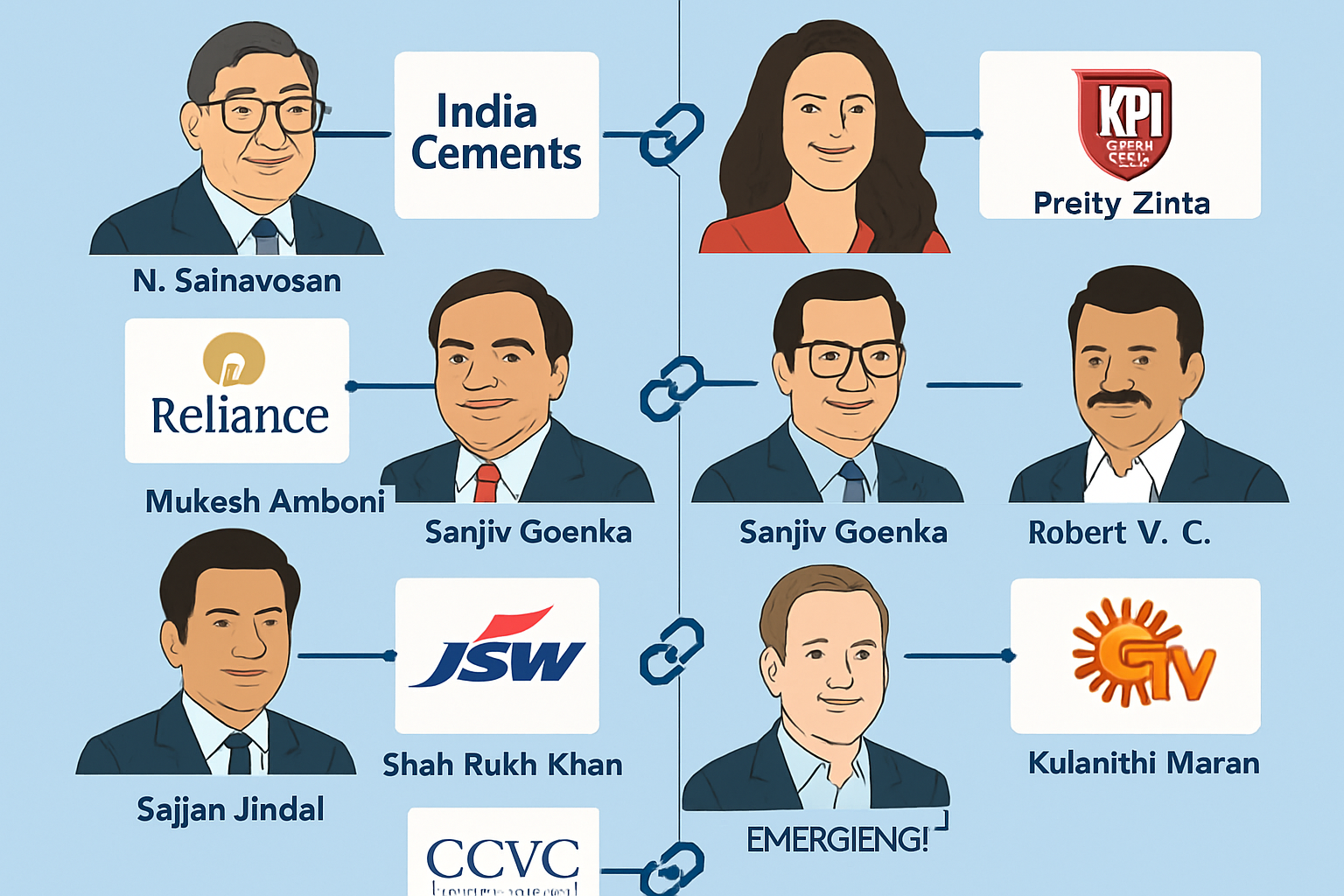

IPL franchise owners at a glance

| Team | Owner Entity | Company/Group | Key Person(s)/Public Face | Notes |

|---|---|---|---|---|

| Chennai Super Kings (CSK) | Chennai Super Kings Cricket Limited | Promoter group linked to India Cements Shareholders Trust | N. Srinivasan (promoter), K.S. Viswanathan (CEO) | De-merger from India Cements created dedicated sportsco; widely held unlisted company with a promoter group in control |

| Mumbai Indians (MI) | Indiawin Sports Private Limited | Reliance Industries group | Nita Ambani, Akash Ambani | Indiawin is a Reliance subsidiary; MI brand expanded into SA20, ILT20, MLC |

| Royal Challengers Bangalore (RCB) | Royal Challengers Sports Private Limited | United Spirits (Diageo India) | Prathmesh Mishra (Chairman), key executives appointed by Diageo | Wholly owned by United Spirits via a dedicated sports subsidiary |

| Kolkata Knight Riders (KKR) | Knight Riders Sports Private Limited | Red Chillies Entertainment & Mehta Group | Shah Rukh Khan, Juhi Chawla, Jay Mehta | Split historically reported around 55:45 between SRK’s side and Mehta Group |

| Sunrisers Hyderabad (SRH) | Sun TV Network group | Sun TV Network | Kalanithi Maran, Kavya Maran | Corporate ownership through Sun TV’s sports vertical; Kavya is the consistent public face |

| Rajasthan Royals (RR) | Royal Multisport Private Limited | Emerging Media with co-investors | Manoj Badale | Emerging Media is majority; investors include RedBird Capital and Murdoch family interests |

| Delhi Capitals (DC) | JSW GMR Cricket Private Limited | JSW Sports and GMR Group (joint venture) | Parth Jindal, Kiran Kumar Grandhi | 50:50 JV; rebrand from Delhi Daredevils to Delhi Capitals marked shift in strategy |

| Punjab Kings (PBKS) | KPH Dream Cricket Private Limited | Burman (Dabur), Wadia, Preity Zinta, Apeejay Surrendra | Mohit Burman, Ness Wadia, Preity Zinta, Karan Paul | Multi-promoter structure; share splits vary by filings and transactions |

| Gujarat Titans (GT) | CVC Capital Partners (SPV) | CVC Capital Partners | Board-led; Siddharth Patel (CVC) often cited | Private equity-owned franchise; professionalized management layer |

| Lucknow Super Giants (LSG) | RPSG Sports Private Limited | RP-Sanjiv Goenka Group | Sanjiv Goenka | Diversified conglomerate; strong playbook from previous franchise experience |

How IPL ownership actually works

- League vs franchise: The IPL is owned and governed by the BCCI. Teams don’t “own the league”; they own the right to field a franchise, build a brand, and monetize it within the IPL framework. The IPL Governing Council sets rules, and the BCCI manages central rights like broadcast.

- Central vs local revenue: A large share of media-rights income goes to a central pool and is distributed to teams under a predefined formula that blends equal distribution and performance components. Local revenue—sponsorships, tickets, hospitality, and merchandising—sits with the franchise.

- Cost base: The biggest guaranteed cost is the player purse. Add coaching staff, analytics, scouting, academy runs, match operations, and stadium rentals (or revenue-share with state associations or stadium operators).

- Profitability: After the latest media-rights escalation, most well-run teams are now comfortably profitable across the season. The expansion and global sister-club strategy has added new sponsorship inventory and stronger negotiating leverage.

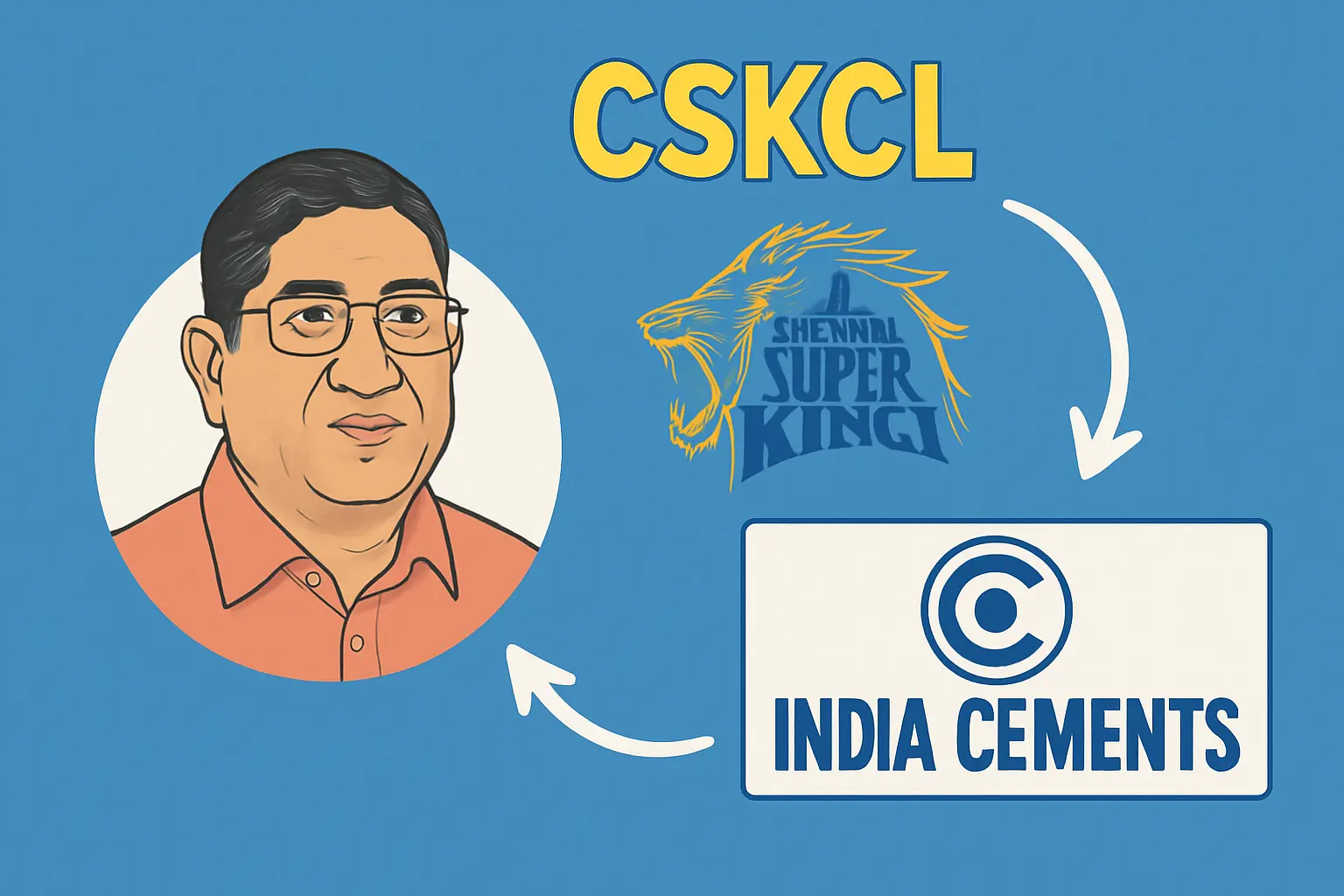

Owner of Chennai Super Kings (CSK)

Corporate entity: Chennai Super Kings Cricket Limited (CSKCL)

Promoter/control: India Cements Shareholders Trust (promoter group); N. Srinivasan as the key promoter figure

Public face and management: N. Srinivasan as patriarchal figure; K.S. Viswanathan as CEO; the cricket brain trust includes Stephen Fleming and a famously consistent backroom.

CSK’s ownership arc reads like a classic Indian corporate restructure. The team began under India Cements’ umbrella and then moved into a separate vehicle (CSKCL) via a de-merger that allowed a sports-first balance sheet with its own shareholders. While CSKCL is an unlisted public company, the promoter group anchored by the India Cements Shareholders Trust gives the Srinivasan camp enduring control.

What makes CSK distinct isn’t only the corporate plumbing—it’s the cultural continuity that owner-promoters have insisted upon. They built a system that values clarity of roles and trust in veterans; it shows in retention decisions and the trademark calm in high-pressure chases. Financially, CSKCL has matured from a franchise-dependent entity into a sports company with multi-sport ambitions and a recognisable brand identity that commands premium sponsorships. In cross-league play, the Super Kings ecosystem stretches into SA20 and Major League Cricket, where the brand has replicated its “do simple things well” mantra with local tweaks.

Owner of Mumbai Indians (MI)

Corporate entity: Indiawin Sports Private Limited

Parent: Reliance Industries group

Public face: Nita Ambani and Akash Ambani

Mumbai Indians is the case study for scaling a franchise into a global multi-club model. Indiawin Sports, a Reliance subsidiary, runs MI and its sister teams—MI Cape Town (SA20), MI Emirates (ILT20), and MI New York (MLC). The playbook is corporate-grade: deep scouting networks, data science benches, and a sponsorship portfolio that looks more like an FMCG major than a sports team.

Nita Ambani is the visible face; Akash Ambani’s growing operational role shows in auction tables and decisions that marry short-term needs with roster churn discipline. The MI brand leans hard into youth renewal—keeping a fast bowling pipeline alive, trusting modern T20 hitters early, and treating captaincy as a strategic role rather than a permanent one. Financially, being inside Reliance unlocks premium partnerships and international footprints that few can match. Indiawin’s complete ownership keeps decision loops short, which matters when you need to move fast in trade windows or pivot strategies mid-season.

Owner of Royal Challengers Bangalore (RCB)

Corporate entity: Royal Challengers Sports Private Limited (RCSPL)

Parent: United Spirits Limited (Diageo India)

Public face: Executives appointed by Diageo; the brand aura long tied to stars and the Chinnaswamy roar

RCB is wholly owned by United Spirits via RCSPL, making it one of the cleanest corporate-ownership structures in the league: a listed alcohol-beverage giant ring-fences sports operations in a subsidiary and applies governance rigor—audits, quarterly disclosures, brand safeguards. This clarity influences everything from long-term cap planning to community engagements like the “Green Game.”

RCB’s owner history traverses flamboyance and consolidation. The modern phase is sober, metrics-driven, and brand-protective. You can see it in decisions to invest in fitness and pace resilience in a batting-friendly home venue, or in front-office hires from professional sport backgrounds. United Spirits’ consumer-brand heft helps with topline sponsors who want national activation footprints; Bangalore’s urban audience delivers engagement that advertisers crave.

Owner of Kolkata Knight Riders (KKR)

Corporate entity: Knight Riders Sports Private Limited (KRSPL)

Promoters: Red Chillies Entertainment (Shah Rukh Khan, Gauri Khan) and Mehta Group (Juhi Chawla, Jay Mehta)

Reported split: Commonly cited as roughly 55:45 between the SRK side and Mehta Group

Public face: Shah Rukh Khan, Juhi Chawla, Jay Mehta; Venky Mysore (CEO) as the steady operator

KKR is where Bollywood glamour met meticulous sports business. The glitz was never just for show—behind it sits Venky Mysore’s CEO-style ownership execution: centralised analytics, coaching consistency, and a multi-league network under the Knight Riders banner. The group owns teams in the Caribbean (Trinbago Knight Riders), the Gulf (Abu Dhabi Knight Riders), and the US (LA Knight Riders in MLC). That network creates player pathways and scouting feedback loops KKR can exploit ahead of auctions.

From a profit lens, KKR leverages one of the league’s most recognisable brands—thanks to SRK’s global pull—and a content engine that runs year-round. Stake specifics can vary by filings, but the enduring partnership between Red Chillies and the Mehta Group remains the bedrock. If you study their auction tables across seasons, there’s a pattern: buy multi-skill cricketers, and bet on high-ceiling domestic players even if it means a volatile short-term graph.

Owner of Sunrisers Hyderabad (SRH)

Corporate entity: Sunrisers Hyderabad Cricket Private Limited (Sun TV Network group)

Parent: Sun TV Network

Public face: Kalanithi Maran; Kavya Maran as the day-to-day face at the auction table and in the stands

SRH is the most TV-like franchise in its cadence—disciplined budgets, centralised approvals, and a keen eye on broadcast-value players. Owned by the Sun TV Network, SRH benefits from a media-first mindset. The Maran family’s corporate machine ensures timely decisions and solid sponsor pipelines, particularly in south India.

The team has often been a bowler’s laboratory, resilient on tricky surfaces, trusting legspinners and hit-the-deck pacers. In recent seasons, a bolder batting identity has emerged, reflecting a franchise comfortable with reinvention. Kavya Maran’s visibility has made her synonymous with the brand; operational depth comes from a core exec group with roots in media and sports marketing.

Owner of Rajasthan Royals (RR)

Corporate entity: Royal Multisport Private Limited

Promoter/majority: Emerging Media (Manoj Badale)

Co-investors: RedBird Capital Partners, Murdoch family interests, and others

Public face: Manoj Badale

Rajasthan Royals remains the romantic’s franchise, but the boardroom is distinctly modern. Emerging Media, led by Manoj Badale, is the anchor shareholder, with strategic investors like RedBird bringing US sports expertise. RR’s cross-league presence—Paarl Royals in SA20 and Barbados Royals in the Caribbean—has given them a Southern Hemisphere pipeline and a strong data culture.

From an ownership perspective, RR is an exemplar of “smart money” sports investing: smaller city, big scouting, agile coaching hires, and targeted marketing that turns underdog narratives into loyalty. The front office is known for its appetite for left-field signings and performance science experiments, from workload tracking to multi-skill development. Revenue-wise, the Royals have turned their boutique positioning into a sponsor-friendly story: innovation, youth, and values-led branding.

Owner of Delhi Capitals (DC)

Corporate entity: JSW GMR Cricket Private Limited

Ownership: 50:50 joint venture between JSW Sports and GMR Group

Public face: Parth Jindal (JSW) and Kiran Kumar Grandhi (GMR)

DC is a case study in a successful sports joint venture. JSW brings youthful aggression and high-performance structures; GMR contributes venue expertise and event operations. Together they turned a middling brand into a brushed-steel contender. The renaming from Delhi Daredevils to Delhi Capitals signaled the pivot: invest in domestic cores, build around youth, hire hard-nosed coaching staff, and keep a clear line from the academy to the first team.

Because the shareholding is perfectly split, decisions are consensus-driven—but not slow. The JV enjoys a healthy division of responsibilities, and you see the benefits in their multi-league ventures: Pretoria Capitals in SA20 and Dubai Capitals in the ILT20, creating a twin-city capital brand. Commercially, the Delhi market offers deep sponsor pools; the joint venture structure gives institutional comfort to large partners.

Owner of Punjab Kings (PBKS)

Corporate entity: KPH Dream Cricket Private Limited

Promoter group: Mohit Burman (Dabur group), Ness Wadia (Bombay Burmah/Britannia lineage), Preity Zinta (PZNZ Media), Karan Paul (Apeejay Surrendra)

Public face: Preity Zinta, Mohit Burman, Ness Wadia

Punjab Kings has the most eclectic promoter group in the league: FMCG lineage via the Burmans, storied business houses via Wadia and Paul, plus a celebrity co-owner in Preity Zinta. The shareholding has shifted over time through internal transactions, but the four-sided structure has endured.

PBKS feels entrepreneurial. They gamble in auctions, they swing big with batters, and they aren’t afraid to reset. The trade-off is volatility; the upside is entertainment. From a commercial perspective, the mix of owners opens doors to different sponsor networks—CPG, lifestyle, hospitality, and media. KPH also owns Saint Lucia Kings in the Caribbean, giving the group a West Indies talent pipeline and a summer brand extension. Operationally, they’ve become sharper about role clarity and fitness standards, a sign of better alignment across the promoter table.

Owner of Gujarat Titans (GT)

Corporate entity: CVC Capital Partners (via a dedicated SPV)

Parent: CVC Capital Partners

Public face: Senior CVC executives; the coaching group became the immediate brand carriers

Gujarat Titans emerged from a private equity play that got the fundamentals right from day one: strong coaching leadership, clear philosophy on pace and all-rounders, and crisp contract management. CVC’s ownership brings institutional rigor—governance, financial discipline, and an investor’s appetite for scalable processes.

GT built an identity quickly: bowl fast, field hard, and trust flexible finishers. Their commercial arm found quick wins with regionally resonant sponsors and a city-pride narrative. For CVC, the franchise sits within a broader sports portfolio know-how, with deliberate separation between investment committee decisions and day-to-day cricket operations. The result is a brand that feels both professional and emotionally grounded in Gujarat.

Owner of Lucknow Super Giants (LSG)

Corporate entity: RPSG Sports Private Limited

Parent: RP-Sanjiv Goenka Group

Public face: Sanjiv Goenka

LSG is run like a top-tier consumer company: measured, research-led, and relentlessly on-message. The RP-Sanjiv Goenka Group, with prior franchise experience in the league, brought a full operating manual—analytics partnerships, leadership development for support staff, and attention to the fan experience that goes beyond stadium hours.

The brand is distinct: modern, energetic, and digitally forward. You can see RP-SG’s imprint in the way LSG sells hospitality, the care taken in training facility upgrades, and the way they package content for multi-language audiences. As an owner, Sanjiv Goenka is present but not intrusive, trusting his front office and coaches to execute within a strategic blueprint.

Who owns the IPL?

The league is owned by the Board of Control for Cricket in India (BCCI). The IPL Governing Council administers the tournament. Franchises are the owners of their respective teams, not the league itself. They hold the rights to represent a city/region and the commercial assets tied to their brand within the IPL’s regulatory framework.

Ownership percentages and reality checks

- Precise stakes are fluid: Unlisted companies don’t always disclose granular cap tables in real time. Where stakes are publicly documented—like DC’s 50:50 JV or RCB’s wholly-owned subsidiary status—we’ve stated them. For others, including KKR and RR, widely reported splits are directional and can be refined by corporate filings.

- Control vs ownership: In Indian corporate practice, a promoter group can control a company without owning an absolute majority, via aligned shareholders and trusts. CSK is a good example—the promoter trust anchors control, with institutional and public shareholders alongside.

How much does an IPL team cost?

The cost profile blends an upfront franchise fee (paid across instalments) and ongoing operating expenses. In the expansion phase that brought in Gujarat Titans and Lucknow Super Giants, the winning bids reset the market—numbers soared into thousands of crores, reflecting the league’s step-change in media-rights value and growth expectations. Today, a realistic total cost-of-ownership calculation includes:

- Franchise fee amortization

- Player purse

- Support staff, analytics, and scouting programs

- Matchday operations, stadium rentals, and revenue-share with local associations

- Marketing, content, and community initiatives

- Academy and development pathway investments

Return comes via the central revenue distribution, local sponsorships, ticketing and hospitality, licensing, and—critically—brand equity that compounds over seasons. Franchises with multi-league footprints can cross-sell sponsors, smooth seasonality, and drive down content production costs per team via shared services.

Franchise valuations and brand value

Valuations have marched upward as:

- Media rights climbed dramatically, creating predictable central distributions

- Teams professionalized scouting and performance structures (which translates to on-field consistency and off-field cachet)

- Multi-league strategies unlocked global fanbases and sponsor networks

- Player narratives and long-term domestic cores created dependable engagement

Brand value rankings shuffle with on-field performance, but the top tier typically clusters around MI, CSK, KKR, RCB, with DC, RR, SRH, PBKS forming a lively second tier. The new teams, GT and LSG, have moved faster than older franchises did at the same age—helped by a larger league footprint, aggressive digital play, and brisk success on the field.

WPL owners and how they map to IPL franchises

The Women’s Premier League (WPL) brought a fresh wave of ownership energy. Several IPL owners extended their sports portfolios; a couple of prominent business houses jumped in anew. Here’s the quick mapping:

- Mumbai Indians Women (MI Women): Owned by Indiawin Sports (same corporate owner as MI). Strong brand continuity, with shared analytics and commercial playbooks.

- Royal Challengers Bangalore Women (RCB Women): Owned by United Spirits via the same sports entity umbrella. The RCB brand’s urban, progressive positioning resonates strongly in the women’s space.

- Delhi Capitals Women: Owned by the JSW GMR joint venture, mirroring the men’s team. The twin “Capitals” approach (with Pretoria) gives DC a year-round high-performance pathway.

- Gujarat Giants Women: Owned by Adani Sportsline (Adani Group). Note the twist—Adani owns the WPL team but not the GT men’s franchise. That mix confuses casual fans; it’s a great example of brand-work needed in multi-league ecosystems.

- UP Warriorz: Owned by Capri Global. Another fresh entrant without an IPL men’s team, they’ve carved out a distinctive identity anchored in UP’s vast fanbase.

The crossover matters. Shared assets—data teams, high-performance staff, partner networks—give owners a compounding advantage. The WPL’s growth trajectory also helps IPL owners expand their brand presence across the calendar and across demographics.

Richest IPL team owners and their business empires

- Reliance Industries (MI): Among India’s most valuable companies, RIL’s sports vertical runs through Indiawin Sports. Access to capital, world-class management systems, and a robust partner ecosystem make MI a commercial juggernaut.

- Sun TV Network (SRH): One of the largest media networks in the south, with deep regional influence that translates to strong sponsor relationships and broadcast synergies.

- RP-Sanjiv Goenka Group (LSG): A diversified conglomerate with power, retail, and FMCG interests. Professional management culture and prior sports experience form a formidable base.

- CVC Capital Partners (GT): A global private equity firm with a sophisticated playbook for scaling sports assets, governance standards, and value creation via operational upgrades.

- United Spirits (RCB): Backed by Diageo, USL is a consumer brand giant. Their in-house capabilities in marketing, compliance, and brand safety give RCB elite support.

- JSW and GMR (DC): A combination of industrial scale and infrastructure expertise. The JV structure blends strengths smartly.

- KKR’s promoter duo (SRK/Red Chillies and Mehta Group): A star-powered marketing machine married to steady industrial backing. The Knight Riders’ global expansion is fuelled by that two-engine model.

- CSKCL promoter group: A sports-driven company with a strong promoter in N. Srinivasan and a culture of structural discipline.

- PBKS promoter mix: Business families plus celebrity energy; an unusual but resilient cap table.

- RR’s investor set: Emerging Media with serious co-investors like RedBird—smart capital with a long view.

How IPL teams actually make money

- Central pool distributions: A share of broadcast and digital rights—predictable, seasonally distributed cashflow.

- Team sponsorships: Title partner, principal partners, sleeve and back-of-jersey slots, training kits, digital content rights sponsors. The top franchises stitch global and regional partners for better yield.

- Ticketing and hospitality: Big-city teams can squeeze more here, but regulations and stadium deals vary. Smart franchises invest in premium hospitality to smooth variability.

- Merchandising and licensing: A growing but still under-penetrated revenue line; multi-league owners have an advantage.

- Prize money: Helpful, not central.

- International sister clubs: Multi-league networks create new inventory to sell twelve months a year and enable bundled deals.

Celebrity owners and the power of narrative

A truth the balance sheets only hint at: narrative sells. When Shah Rukh Khan hugs a rookie on the boundary or Preity Zinta applauds a young quick’s spell, it socializes the brand. Celebrity owners are not just billboards; the best of them spark stories that amplify across screens. Corporates understand this and increasingly treat content as a strategic asset, not a vanity project.

Team-by-team quick hitters (tactical and financial angles)

- CSK: Promoter-led discipline, long rope for core players, low-noise management. Sponsorships skew premium and long-term. Fan community activation is second to none.

- MI: Global network, aggressive succession planning, and the deepest analytics bench. Sponsor mix includes blue-chip global brands. Smooth on-ramps for academy talent.

- RCB: Brand love exceeds trophies—commercial gold. Home-ground batting conditions nudge squad balance; front office has adapted by investing in high-pace resources and death bowling skills.

- KKR: Multi-league strength, content machine, and all-rounder obsession that matches Eden’s demands. Ownership synergy through Knight Riders Group aids global scouting.

- SRH: Media network backing, clarity in role-based selections, and strong value contracts. Fans appreciate bowling identity; recent batting recalibration hints at a broader template.

- RR: Scouting-first franchise, unafraid of unconventional picks. Cross-league assets in Paarl and Barbados keep the form curve live through the year. Investors push for repeatable processes.

- DC: JV efficiency, academy investments, and a young core with room to peak. The Delhi market rewards scale in sponsorship activations.

- PBKS: Entrepreneurial risk-taking; if they bottle consistency, commercial upside will follow naturally. Caribbean sister club supports T20 skill pipelines.

- GT: Private equity play with focus on systems. Early success cemented a “fearless but structured” identity, attractive to sponsors who like certainty.

- LSG: Conglomerate polish, calm CEO-style structure, and methodical talent development. Hospitality play is sophisticated for a newer franchise.

WPL owners list and linkage to IPL

- Mumbai Indians Women: Indiawin Sports (same as MI). Shared sports science resources; combined partner portfolios.

- Delhi Capitals Women: JSW GMR joint venture. Unified Capitals brand across men’s, women’s, and SA20.

- Royal Challengers Bangalore Women: United Spirits (same as RCB). Digital-first content strategy resonates with a younger audience.

- Gujarat Giants Women: Adani Sportsline (Adani Group). Not linked to the men’s GT—two different owners, two different strategies, one big market.

- UP Warriorz: Capri Global. Strong finance-sector backing; grassroots plans in UP give long-term depth.

Global networks: where IPL owners play elsewhere

- Knight Riders Group: Trinbago Knight Riders (CPL), Abu Dhabi Knight Riders (ILT20), LA Knight Riders (MLC). One of the most complete multi-league ecosystems.

- Mumbai Indians: MI Cape Town (SA20), MI Emirates (ILT20), MI New York (MLC). Multicontinental talent and content loops.

- Super Kings: Joburg Super Kings (SA20), Texas Super Kings (MLC). A measured, culture-first expansion.

- Rajasthan Royals: Paarl Royals (SA20), Barbados Royals (CPL). Southern Hemisphere synergy.

- Delhi Capitals owners: Pretoria Capitals (SA20), Dubai Capitals (ILT20). The Capitals brand travels.

- Sunrisers: Sunrisers Eastern Cape (SA20). Matches SRH’s balance-first cricket philosophy.

- Punjab Kings owners: Saint Lucia Kings (CPL). Caribbean link helpful for white-ball skills.

- Others: RCB, GT, and LSG are selective, focusing on consolidating IPL plus localized ventures; future entries remain possible given the owners’ appetite.

FAQs: quick, precise, and evergreen

Who is the owner of IPL teams?

Each team is owned by a separate company. The league itself is owned by the BCCI. Franchises own the rights to participate and commercialize their team brands within IPL rules.

Who owns Mumbai Indians?

Indiawin Sports Private Limited, a subsidiary of the Reliance Industries group. Nita Ambani and Akash Ambani are the public faces of the franchise.

Who is the owner of CSK?

Chennai Super Kings Cricket Limited. Control lies with a promoter group linked to the India Cements Shareholders Trust; N. Srinivasan is the key promoter figure.

Who owns RCB?

United Spirits Limited (Diageo India) via Royal Challengers Sports Private Limited, a wholly-owned subsidiary.

Which IPL team is owned by Shah Rukh Khan?

Kolkata Knight Riders (KKR). Ownership sits in Knight Riders Sports Private Limited, promoted by Red Chillies Entertainment and the Mehta Group.

What percentage of KKR does SRK own?

Public disclosures indicate Knight Riders Sports is promoted by Red Chillies Entertainment (SRK and Gauri Khan) and the Mehta Group (Juhi Chawla and Jay Mehta), commonly reported around a 55:45 split. Exact numbers can move with internal transactions and filings.

Who is the owner of SRH?

Sun TV Network group. Kalanithi Maran is the promoter; Kavya Maran is the consistent public face.

Rajasthan Royals owner?

Royal Multisport Private Limited. Majority owned by Emerging Media, led by Manoj Badale, with strategic co-investors including RedBird Capital and Murdoch family interests.

Delhi Capitals owner?

JSW GMR Cricket Private Limited, a 50:50 joint venture between JSW Sports and GMR Group.

Punjab Kings owner?

KPH Dream Cricket Private Limited, promoted by Mohit Burman, Ness Wadia, Preity Zinta, and Karan Paul.

Gujarat Titans owner? Is CVC Capital still the owner?

Owned by a CVC Capital Partners special purpose vehicle. Yes, the franchise is in the CVC portfolio and run with professional management.

Lucknow Super Giants owner?

RPSG Sports Private Limited, part of the RP-Sanjiv Goenka Group. Sanjiv Goenka is the public face.

Who is the richest IPL team owner?

By group net worth and market capitalization, Reliance Industries (MI) stands tallest. Among individuals, top conglomerate promoters like Nita and Mukesh Ambani and Sanjiv Goenka headline. Private equity ownership (CVC) represents a different kind of capital strength.

Do IPL owners make profit? How do teams earn money?

Yes, most franchises are profitable across the season today. Revenue comes from central media distributions, sponsorships, ticketing and hospitality, licensing, and prize money. Costs are dominated by player salaries, staff, and match operations. Multi-league expansion increases revenue surface area.

WPL owners list?

MI Women (Indiawin/Reliance), DC Women (JSW GMR), RCB Women (United Spirits), Gujarat Giants Women (Adani Sportsline), UP Warriorz (Capri Global).

Which company owns RCB?

United Spirits Limited, through Royal Challengers Sports Private Limited.

Who owns the Gujarat Giants women’s team?

Adani Sportsline (Adani Group). Not the same as Gujarat Titans in the IPL.

Hindi/Hinglish quick answers

MI ka owner kaun hai? Indiawin Sports (Reliance group). Nita Ambani, Akash Ambani public face.

CSK ka owner kaun hai? Chennai Super Kings Cricket Limited; promoter N. Srinivasan group.

RCB ka malik kaun hai? United Spirits (Diageo). Team entity: Royal Challengers Sports.

KKR ka malik kaun hai? Knight Riders Sports—Shah Rukh Khan (Red Chillies) aur Mehta Group.

SRH ka owner kaun hai? Sun TV Network; Kavya Maran public face.

RR ka owner kaun hai? Emerging Media (Manoj Badale) ke through Royal Multisport.

DC ka owner kaun hai? JSW aur GMR ki 50:50 JV—JSW GMR Cricket.

PBKS ka owner kaun hai? KPH Dream Cricket—Mohit Burman, Ness Wadia, Preity Zinta, Karan Paul.

GT ka owner kaun hai? CVC Capital Partners.

LSG ka owner kaun hai? RP-Sanjiv Goenka Group (RPSG Sports).

Ownership myths and clarifications

- “The IPL is owned by the richest team.” No. The league is owned by BCCI; teams are franchises participating under a contract.

- “Celebrities own entire teams personally.” Rarely. Most celebrity owners are promoters of the holding company or co-promoters alongside a corporate.

- “WPL team owners are the same as IPL owners.” Sometimes yes (MI, DC, RCB), sometimes no (Adani for Gujarat Giants Women, Capri Global for UP Warriorz).

- “Private equity won’t stick around in sport.” CVC’s strategy contradicts this—sports can provide annuity-like cash flows, brand equity, and cross-asset synergies.

Sponsorship trends: how owners think

- Inventory is shifting from static placements to content-led activations. Owners are building in-house content studios to serve sponsors with episodic formats, behind-the-scenes access, and short-form social bursts.

- Regionalization is real. South Indian brands gravitate toward SRH and CSK; western financial services brands often lean to MI; tech-forward brands feel at home with RCB and DC. Owners plan tiered rate cards accordingly.

- Sustainability narratives matter. RCB’s “Green Game,” CSK’s community programs, and DC’s academy emphasis give sponsors values-aligned stories to tell.

The human side: why ownership styles shape cricket decisions

- Patience premiums: CSK’s promoter-led steadiness cashes out when other teams churn. That steadiness is a direct ownership philosophy.

- Professional governance: MI and KKR leverage board-level discipline to keep emotions out of big auction calls—saying no to fan-pleasing but ill-fitting signings.

- Risk appetite: PBKS and RR often take scouting-led punts on uncapped players or hybrid-role cricketers. Owners who embrace calculated risk let their analysts and scouts lead.

Key takeaways

- Every IPL team is owned by a company; the public face may be a promoter, celebrity, or appointed executive.

- Stakes vary; where public and stable (RCB, DC), we’ve stated them; others are directional due to unlisted-company opacity.

- Cross-league footprints (SA20, ILT20, CPL, MLC, WPL) are the new moat. Owners who operate multi-club networks create compounding advantages in scouting, content, and sponsorship.

- Profitability is now the norm, not the exception. The media-rights wave and better cost discipline changed the math.

- The WPL has expanded the ownership footprint and brought fresh capital and audiences into the ecosystem.

Team owner capsules (extended detail)

Chennai Super Kings (CSK) — governance and legacy

CSKCL’s promoter-controlled structure keeps decision-making compact. The trust model, common in India’s corporate landscape, aligns with a long-horizon philosophy. On the ground, the CEO-led operating style gives coaches and the captain extraordinary autonomy. Sponsors value the predictability—contracts renew at premium rates because CSK delivers stable impressions and an unmistakable brand tone: humility, grit, and community.

Mumbai Indians (MI) — scale and systems

Indiawin’s resourcing makes MI an operations superpower. It’s not just the money; it’s the muscle memory of running large, cross-functional programs. MI’s academy architecture is a template for the region: recruitment modules, biomechanics partnerships, strength-and-conditioning cycles synced with international calendars. The ownership’s support for international expansion gave players and staff multi-season workloads and a common vocabulary across teams.

Royal Challengers Bangalore (RCB) — brand-first, data-backed

United Spirits brings compliance and brand safety—a huge plus in a world where a random social post can derail a season’s narrative. The RCB front office has built a global data set on T20 contexts and integrated it into selection. Their venue reality—short boundaries, flat decks—demands relentless innovation in bowling plans. Ownership invests in that innovation rather than pursuing silver bullets.

Kolkata Knight Riders (KKR) — network effects

The Knight Riders Group treats cricket like a content-rich, IP-heavy enterprise. Owning multiple teams allows KKR to cross-deploy coaches, bring academy players into different leagues for exposure, and create docu-content that feeds sponsors across geographies. SRK’s celebrity power garners top-of-funnel attention; the Mehta Group’s steady industrial presence grounds the business.

Sunrisers Hyderabad (SRH) — media logic

Sun TV’s DNA shows up in everything from how SRH negotiates media-facing sponsor packages to how it times announcements. The franchise often finds value in sensible contracts and trusts its coaches to refurbish player roles. The ownership’s blend of discipline and trust has allowed SRH to reinvent itself multiple times without panic.

Rajasthan Royals (RR) — venture mindset

The Royals are venture-capital-like: test, measure, iterate. Investors like RedBird bring sports-science playbooks from global portfolios. RR’s academy programs are designed as product funnels; their analytics team builds role frameworks to slot domestic talent into T20 requirements quicker than rivals. This is ownership acting as an incubator.

Delhi Capitals (DC) — partnership in practice

Equal JVs can stall; this one accelerates. JSW and GMR split responsibilities to avoid duplication. The Capitals’ scouting map is vast, reflecting JSW’s performance-obsessed culture. GMR’s venue and event chops ensure matchday excellence. The brand voice—modern, direct, aspirational—has become consistent across men’s, women’s, and overseas teams.

Punjab Kings (PBKS) — entrepreneurial and passionate

Multiple promoters mean plural viewpoints. When aligned, PBKS can be devastating—big auction hauls, daring strategies. The franchise’s Caribbean sister club improves their contact with all-weather T20 skills. The current phase shows more patience with core groups; ownership is backing the idea that cohesion equals points.

Gujarat Titans (GT) — institutional clarity

CVC’s involvement ensures professional management and board oversight. The Titans’ early identity—fast bowlers, adaptable middle order, calm finishing—won fans and sponsors. Ownership’s temperament is measured: they resist panic buys, prize role players, and allow the cricket leadership to take center stage.

Lucknow Super Giants (LSG) — polished execution

RP-SG’s corporate processes translate into clean, predictable operations. LSG’s fan engagement is thoughtful; their coaching and performance teams speak in the language of role definition and resource planning. Ownership understands that building trust with fans is a long game; they’re comfortable compounding value season by season.

Closing thoughts

The IPL’s owners are not a monolith. They’re a mosaic: conglomerates, media houses, private equity, industrial groups, venture-style investors, and celebrity-led promoters. Their styles shape the cricket you see and the numbers the auditors tally. If you follow the owners, the rest of the IPL makes more sense—the auction table decisions, the mid-season trades, the academy investments, and the jersey-front sponsors that become part of your summer.

For fans, this isn’t just trivia. It’s the economic backbone of the stories you cherish. For sponsors, it’s a way to pick the right partner. For players, it’s the difference between a team that simply signs you and a team that knows exactly why it wants you. That is the power of ownership done right—visible on the scoreboard, audible in the stands, and, increasingly, measurable on the balance sheet.

Zahir, the prolific author behind the cricket match predictions blog on our article site, is a seasoned cricket enthusiast and a seasoned sports analyst with an unwavering passion for the game. With a deep understanding of cricketing statistics, player dynamics, and match strategies, Zahir has honed his expertise over years of following the sport closely.

His insightful articles are not only a testament to his knowledge but also a valuable resource for cricket fans and bettors seeking informed predictions and analysis. Zahir’s commitment to delivering accurate forecasts and engaging content makes him an indispensable contributor to our platform, keeping readers well informed and entertained throughout the cricketing season.