Floodlights crackle, drums roll, and a stadium swells into its own city. An IPL night is part carnival, part trading floor. Prices move with every over, emotions with every shot. Underneath the noise lives a serious business with big-league balance sheets, sharp brand strategy, and rights contracts that would make seasoned media executives sit straighter. The richest IPL team is not just a headline. It is the product of a decade-plus build, carefully engineered monetization, and an evolving relationship between on-field performance and off-field belief.

This is a comprehensive, insider-level guide to the most valuable IPL teams. It blends valuation methodology with ground realities, commercial deals with fan cultures, and brand value with enterprise value. It clarifies the eternal confusion between richest team in IPL, most valuable IPL franchise, and owner net worth. It decodes how IPL teams make money and why two or three names keep hovering at the top. It also captures where the next breakouts will come from and how each franchise is positioning itself for the next surge.

What richest means in IPL economics

The word richest in IPL conversations can get tangled. Four different ideas are usually conflated.

- Brand value: An intangible asset estimate that reflects marketing power, consumer preference, licensing potential, and perceived strength. This is what Brand Finance and D&P Advisory publish. When fans ask which is the richest IPL team, most reliable rankings refer to brand value.

- Enterprise value: A broader estimate of what the franchise would sell for, including equity value plus debt minus cash. In IPL parlance, this is the closest to team net worth but still a valuation construct rather than a bank balance.

- Revenue and profit: The season’s money in and money out. Central revenue share, sponsorships, ticketing and hospitality, and merchandise flow in. Player salaries, support staff, match logistics, marketing, and overheads flow out. The most profitable IPL team in a given season may or may not be the top brand by value.

- Owner net worth: The wealth of the promoter or corporate group that owns the franchise. This can be massive for some teams and modest for others. It is not the team’s value.

Most valuable IPL team: the current pecking order

Authoritative sources—primarily Brand Finance and D&P Advisory (formerly Duff & Phelps)—track IPL brand value using recognized valuation techniques. Their methodologies differ around assumptions for royalty relief, discount rates, and what they consider the brand’s franchise earnings. But across sources, a consensus has formed.

- Mumbai Indians usually lead on overall brand value, built on a multi-title sporting dynasty, global academy network, and a sponsor portfolio that looks like a stock index.

- Chennai Super Kings track extremely close and sometimes overtake depending on the season, with brand strength fueled by stability, the Dhoni aura, and a mass-market resonance that advertisers crave.

- Kolkata Knight Riders and Royal Challengers Bengaluru sit in the next tier. KKR’s celebrity-led appeal and multi-club footprint combine with east-zone dominance. RCB’s loyal fanbase, Virat Kohli’s magnetism, and commercial sophistication keep them perennially high even without a trophy glut.

- The newer franchises—Gujarat Titans and Lucknow Super Giants—are charging up the table faster than most earlier entrants in league history, helped by large home markets and strong early performances.

- Sunrisers Hyderabad, Rajasthan Royals, Delhi Capitals, and Punjab Kings form a competitive middle. Each has distinct strengths: SRH’s southern media power, RR’s youth pipeline and data savvy, DC’s metro-market brands, PBKS’s pan-India diaspora and Bollywood sheen.

A consolidated, source-agnostic view of IPL team brand value and enterprise value

The table below blends what leading valuation firms publish with ecosystem signals: sponsorship rates, ticketing strength, pan-India recall, and multi-market assets. Ranges reflect differences in methodology and rounding for public readability.

| Team | Relative brand value tier | Indicative brand value range (USD) | Indicative enterprise value range (USD) | Core commercial strengths |

|---|---|---|---|---|

| Mumbai Indians | Alpha | 90–120 million | 1.2–1.5 billion | Multi-title dynasty, metro-market dominance, wide sponsor pyramid, global academies |

| Chennai Super Kings | Alpha | 85–115 million | 1.1–1.4 billion | Brand strength index leader, mass-market reach, retention culture, loyal South fanbase |

| Kolkata Knight Riders | High | 75–105 million | 1.0–1.3 billion | Celebrity ownership, cross-league presence, East India grip, strong content studio |

| Royal Challengers Bengaluru | High | 70–100 million | 0.95–1.25 billion | Cult fanbase, Kohli legacy, premium sponsor mix, metro affluence |

| Gujarat Titans | Rising | 55–85 million | 0.8–1.1 billion | Early titles contention, massive new-economy market, fresh sponsor categories |

| Sunrisers Hyderabad | Rising | 55–80 million | 0.75–1.0 billion | Southern TV heft, balanced roster strategy, value sponsors |

| Delhi Capitals | Solid | 50–75 million | 0.7–0.95 billion | Capital-city reach, corporate client base, youth-first brand |

| Rajasthan Royals | Solid | 45–70 million | 0.65–0.9 billion | Innovation reputation, scouting engine, international deals |

| Lucknow Super Giants | Emerging | 45–70 million | 0.65–0.9 billion | North Indian catchment, FMCG-heavy sponsor mix, modern fan engagement |

| Punjab Kings | Emerging | 40–65 million | 0.6–0.85 billion | Diaspora pull, entertainment-led marketing, flexible pricing |

Note: Figures are directional to reflect the relative ladder and reconcile differences between Brand Finance and D&P approaches. They aim to answer the practical question fans and marketers care about: who sits where right now.

Why Mumbai Indians and Chennai Super Kings dominate most valuable IPL team discussions

A modern sports brand is belief first, cash later. MI and CSK built belief systems that almost run themselves.

- Repeatability. Contenders are never far even in transition. That winter of vulnerability most teams fear rarely arrives.

- Systems over stories. Scouting pipelines that reach into overlooked domestic pockets. Specialist support staff. Repeatable roles. Salary cap efficiency.

- Strongholds. High-density metro markets that pay premium rates for hospitality and associate their brands with winners.

- Global templates. Academy footprints, content studios, and sister teams that export learnings back into the IPL mothership. When the cricketing weather shifts, these brands pivot faster.

Brand value vs revenue vs net worth in practice

- Brand value is a marketing asset. It scales sponsor fees, licensing, and even ticket price elasticity. It rises with television moments, title runs, icon continuity, and cultural stickiness. MI and CSK score across these.

- Revenue is the scorecard for a season. Central pool distributions form the base. The richer teams grow their own-layer revenues faster: principal sponsorships, premium inventory, matchday hospitality, and paid content.

- Enterprise value is the blended bet. Private investors price in growth in media rights and internationalization of cricket content. A few franchises now sit comfortably in the billion-dollar conversation across structured deals.

How IPL teams make money

The revenue model is elegantly stacked around one truth: IPL is a television-first property now complemented by full-stadium city events. Teams draw from multiple streams.

- Central pool revenue. Media rights and central sponsorships are pooled by the league and shared with franchises. This is the safety net that makes the league a sturdy business even for mid-table teams.

- Team sponsorships. The largest lever controlled by the franchise. Principal front-of-shirt deals, title partners, sleeve and cap inventory, training kit partners, and a cluster of category-exclusive deals from footwear to fintech. Rates scale with reach, certainty of prime-time slots, and celebrity association.

- Matchday and hospitality. Ticketing, corporate boxes, premium suites, and hospitality packages. Stadium arrangements vary by city and association, so revenue share is not uniform. Metro markets and large-capacity venues tilt the field.

- Merchandise and licensing. A growing but still smaller slice in Indian cricket. It spikes when teams run deep into the playoffs or sign globally resonant players. E-commerce has widened access, and official retail partnerships are improving quality perception.

- Content and digital monetization. Long-form series, behind-the-scenes access, creator-led formats, and direct-to-fan membership products. Teams that behave like media companies during the off-season tend to command higher brand value.

IPL franchise valuation methodology in simple terms

Valuation firms lean on two pillars.

- Royalty relief for brand value. Estimate the brand’s contribution to earnings by calculating the notional royalty a third party would pay to license the brand. Adjust for brand strength, growth, and risk. Discount future brand-related earnings to present value using a rate that reflects sports and India-specific risk.

- Enterprise value triangulation. Cross-check discounted cash flows with market multiples, comparable club transactions, and media-rights benchmarks. Factor in contract lengths, stadium arrangements, and sponsor category depth.

This is why two serious firms can publish different charts yet be directionally aligned. One may assign more weight to brand strength and long-term stability. Another may lean on near-term revenue capacity and sponsor backlog.

Team-by-team snapshot: brand value drivers, revenue mix, and owner lens

Mumbai Indians brand value and finances

- Why MI tops richest team in IPL debates: A dynasty with resilience. Even in seasons of churn, the brand projects calm control. Multiple titles created trust and a generation of fans. The front-office has institutional depth, tightly run scouting, and player development that delivers IPL-ready roles.

- Revenue engine: The most diversified sponsor pyramid in the league, with blue-chip principals at the apex and a deep tail of official partner categories. Hospitality rates in Mumbai are among the highest in Indian sport, and the corporate client base is unmatched. Content output is prolific, underpinned by a media-savvy culture.

- Owner and structure: Backed by one of the largest conglomerates in the country. This brings capital certainty, professional governance, and brand synergy with consumer businesses.

- Off-field advantage: Multiple teams in global T20 ecosystems. Learnings on player rotation, data models, and commercial packaging loop back to the main brand. A true sports holding company play.

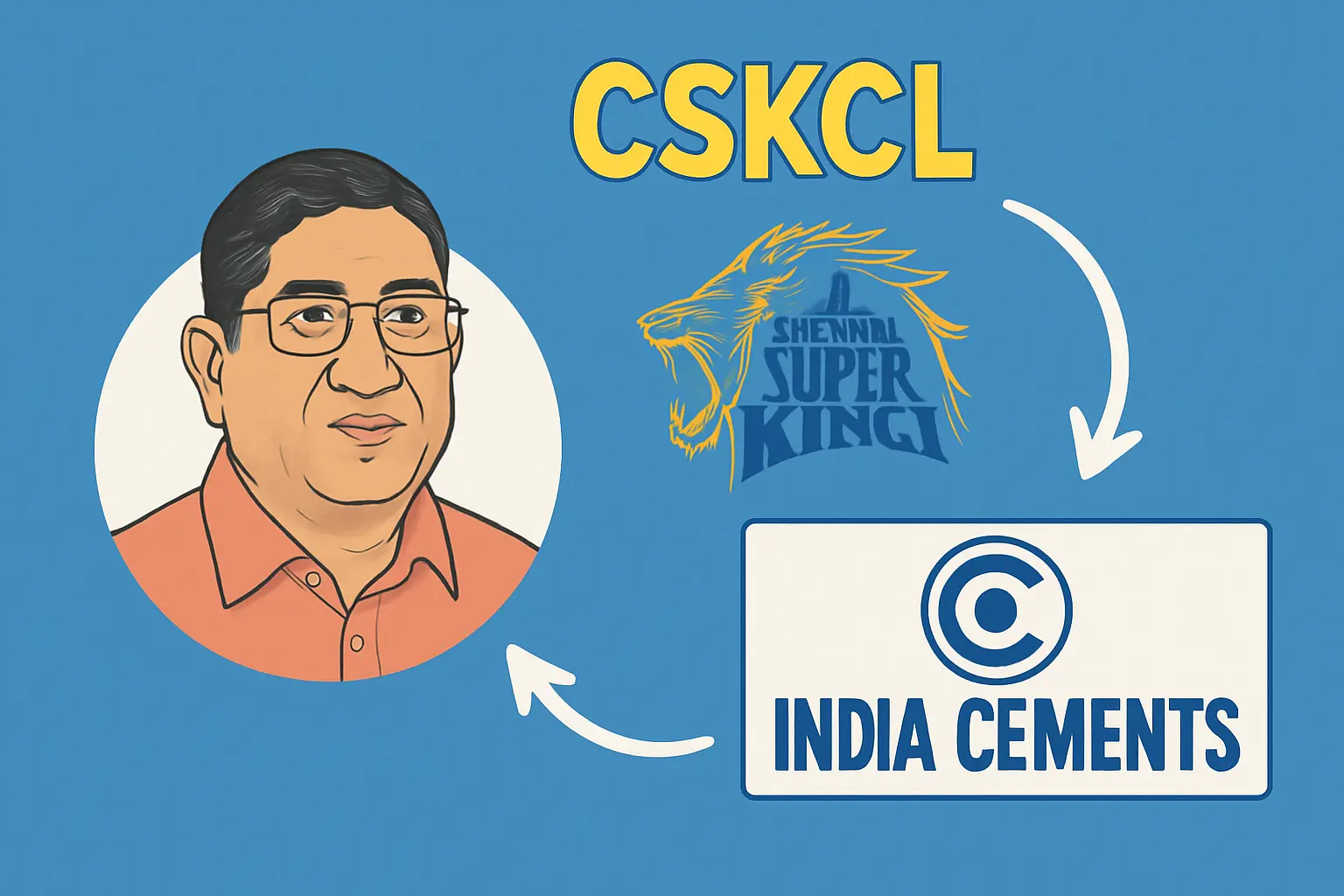

Chennai Super Kings brand value and finances

- Why CSK lives in the top two: Brand strength measured as trust is extraordinary. The team identity is tied to continuity, disciplined retention, and a captain who became a cultural symbol. The fanbase expresses an almost familial loyalty. In brand maps, this is priceless.

- Revenue engine: Mass-market resonance translates to huge television engagement, which sponsors love. The sponsor roster skews toward pan-India consumer brands that want an emotional halo. Ticket demand is unrelenting; premium hospitality sells out quickly in key games.

- Owner and structure: A cricket-first corporate ethos with decades of administrative understanding. The brand trades on authenticity rather than glitz, which attracts a specific advertiser archetype focused on credibility.

- Off-field advantage: Academy programs, grassroots activation in the South, and regional content that hits emotional notes. When the team leans into community, value compounds.

Kolkata Knight Riders brand value and finances

- Brand forces: Celebrity ownership pairs with a competitive, risk-embracing sporting strategy. The chant is a marketing asset by itself and dates back to the earliest days, which matters for legacy recall.

- Revenue engine: Strong merchandise culture, a confident content studio, and cross-pollination from a sister team in another T20 league. Sponsorships enjoy bonus media from celebrity co-marketing and entertainment tie-ins.

- Market edge: Eastern India’s largest urban center delivers scale and a captive media market. The brand also travels well digitally, with meaningful diaspora engagement.

- Owner lens: Entertainment industry instincts keep the brand’s show-business quotient high without undercutting the cricket.

Royal Challengers Bengaluru brand value and finances

- Brand forces: One of the most passionate fan communities in Indian sport. A fiercely loyal metro clientele pairs with national digital armies. The Kohli effect continues to power top-of-mind awareness.

- Revenue engine: Premium sponsor mix with tech-forward categories, affluent buyer base for hospitality, and high social engagement during the season. RCB’s brand is a magnet even in trophy-light years, an unusual sports phenomenon.

- Market edge: A new-economy city that over-indexes on per-fan spending relative to other regions. RCB’s brand proposition is premium, energetic, and youthful.

- Owner lens: A large consumer company with advertising discipline and a clear understanding of brand salience. That keeps the commercial machine focused and measurable.

Gujarat Titans brand value and finances

- Brand forces: A fresh winner’s aura. The team entered the league and immediately set a tone of calm competence. The crest stands for new-market confidence.

- Revenue engine: A massive home market with a showcase stadium and hospitality ladders that rival the best. Quick success accelerated principal sponsorship rates and pulled in categories that prefer performance-led narratives.

- Market edge: A new urban cluster with deep pockets and corporate buyers. The home venue’s scale allows ambitious matchday packaging.

- Owner lens: Investment-firm rigor around commercial execution. The brand carries a modern, professional tone that is friendly to institutional sponsors.

Sunrisers Hyderabad brand value and finances

- Brand forces: Southern media muscle and a consistent conveyor belt of fast bowlers and emerging Indian talent. The region’s loyalty drives TV numbers that sponsors watch closely.

- Revenue engine: Solid principal deals, value-driven partner stable, and ticket demand that rises when the team leans into local heroes. SRH’s sporting character—hardworking and no-frills—attracts sponsors that want competence over spectacle.

- Market edge: An economy with a strong IT backbone and a television market that rewards consistency. Regional content in Telugu and English helps the brand straddle audiences.

- Owner lens: A broadcaster’s instinct for media leverage and audience flow, reflected in smart scheduling of content drops and community integrations.

Delhi Capitals brand value and finances

- Brand forces: The capital city halo helps with B2B relationships and government-adjacent sponsors. A youthful on-field identity and commitment to domestic talent keep the narrative fresh.

- Revenue engine: Corporate hospitality is a strength; sponsor prospecting benefits from the city’s boardrooms. Content strategy aligns with a younger, urban online audience.

- Market edge: A crowded entertainment calendar can be a challenge, but the city’s purchasing power and networking value offset it for brands looking for client entertainment and brand positioning.

- Owner lens: A joint venture of two large, operationally minded groups, which tends to produce stable decision-making and investment in long-term assets like academies.

Rajasthan Royals brand value and finances

- Brand forces: The original disruptors. Innovation in scouting, data-led decisions, and player development has become the calling card. The Royals attract fans who enjoy smart cricket.

- Revenue engine: Sponsor categories that value creativity and youth align with the Royals’ identity. International tie-ups help secure offseason content and training camps.

- Market edge: A heritage-rich home state with top-tier tourism gives the team storytelling material few others possess. The brand resonates beyond scorelines through style and strategy.

- Owner lens: A consortium with serious sports investors, including international capital, that pushes governance standards and commercial innovation.

Lucknow Super Giants brand value and finances

- Brand forces: New-market optimism and a mass of cricket-mad fans across North India. Branding is polished, fan engagement is modern, and the roster has balanced star appeal.

- Revenue engine: FMCG-heavy sponsor base, strong retail activations, and family-oriented hospitality products. The team leans into accessibility while keeping premium layers intact.

- Market edge: Enormous catchment area for both attendance and TV. The franchise has wisely pursued community programs to embed itself in local hearts.

- Owner lens: A diversified business group with mature sports operations experience, allowing quick ramps in commercial structures and partnerships.

Punjab Kings brand value and finances

- Brand forces: Entertainment-first vibe with Bollywood associations and a colorful matchday experience. The crest carries a pan-India name, which aids national recall.

- Revenue engine: Sponsor categories that like high-energy marketing, flexible ticket pricing, and diaspora-friendly digital initiatives. The Kings often test creative content formats that punch above their media spend.

- Market edge: A passionate fan base across northern states and overseas communities. Big moments with a bat or a ball go viral quickly for this franchise.

- Owner lens: A promoter group comfortable with consumer marketing and brand partnerships. They value agility and experimentation and can pivot sponsor strategies mid-season.

Richest IPL team and the owner net worth trap

One of the lazest narratives in the ecosystem equates owner wealth with franchise value. A deep-pocketed owner can underwrite short-term losses, invest in academies, and fund technology. That can accelerate brand value growth. But it does not automatically make a team the most valuable IPL franchise.

- Owner wealth is private capital, not team value.

- Team value is priced off rights contracts, brand strength, and cash flow durability.

- Good governance and sporting models can beat bank balances in the long run.

MI vs CSK brand value: the rivalry inside the rivalry

Two superclubs define an era. On the park, they have traded titles and classics. Off the park, they trade advantages season after season.

- MI’s breadth. A bigger city, a broader sponsor pyramid, and a global academy network that aligns neatly with blue-chip brands. Multiple superstar eras keep content fresh.

- CSK’s depth. Unmatched brand trust in India’s southern heartlands and beyond. A personality-driven identity that advertisers find stable. More people can guess the CSK identity in a blind test than perhaps any other domestic sports team.

- Verdict in valuation terms. On many days, MI edges on absolute brand value across certain methodologies. On many others, CSK ties or leads on brand strength and conversion of eyeballs into sponsor yield. The gap is razor thin, and that tension is precisely why both sit at the summit.

Revenue sharing and central pool economics explained

The league’s central deals pay the mortgage. Media rights and central sponsorships feed a revenue pool that is shared with teams. Key dynamics carry through each cycle.

- More households watching IPL and higher per-match ad yields lift the central pool. That usually means guaranteed base revenue for all teams.

- Teams with larger independent revenue engines—sponsorships, hospitality, and licensing—become less dependent on the central pool and move up the profitability ladder.

- The richer franchises convince brands to commit multi-season, premium-priced deals. That certainty supports higher valuations.

Sponsorship market trends touching IPL team finances

- Category rotation. Fintech, fantasy gaming, edtech, and D2C have come in waves. Automotive, beverages, telecom, and consumer electronics keep the base solid.

- Compliance and brand safety. Teams vet partners with more rigor. The sponsor roster is cleaner, contractually tighter, and better diversified than before.

- Content-first partnerships. Sponsors now demand storytelling, not just logo space. Teams that can produce authentic, high-velocity content command a premium.

Matchday and stadium economics that separate leaders from followers

- Hospitality ladders. Franchises with wider, thoughtfully priced corporate hospitality can earn more per game than rivals. Curated experiences, brand-led suites, and on-site activations multiply yields.

- Venue control and sharing. State associations own most venues, which means revenue splits and operational control vary. Smooth, long-term agreements have a direct impact on profit margins.

- Ticket pricing power. Winning breeds pricing power. So does certainty. Brands like MI and CSK do not have to discount to fill. Rising teams like GT and LSG are already showing that elasticity in key fixtures.

Merchandise and licensing: a small slice with large signaling power

Merch still contributes a minor share compared to football giants in Europe or basketball franchises in the United States. But it matters more than the line item suggests.

- Signal of affinity. When the jersey becomes streetwear, sponsors take notice.

- Counterfeit control. Teams that invest in anti-counterfeit and official retail partners improve unit economics and trust.

- Player-led capsules. Limited drops around captains, icons, or milestone games sell through faster and lift perceived brand value.

Auction purse and salary cap: the most misunderstood link to richest team in IPL

Salary cap allocation is standardized across teams. The auction purse is not a measure of wealth. It is a competitive control that keeps the field level. Richer teams do not get a bigger purse. They get a longer line of sponsors and a stable front office. The edge appears in scouting, role clarity, and retention strategy rather than chequebook size.

Cricket performance vs franchise valuation: what really moves the needle

- Titles accelerate trust but do not guarantee valuation superiority. RCB’s consistent high ranking without a title spree is proof.

- Icon continuity is value-dense. Long runs with a beloved captain or superstar give brands predictability.

- Market access beats sporadic winning. A team that wins occasionally but lives in a smaller market must overachieve in commercial creativity to keep pace with big-city giants.

Richest IPL team by revenue vs by brand value

- By revenue, the teams with the biggest local markets and the heaviest sponsor rosters tend to sit on top. MI and CSK are fixtures, with KKR and RCB frequently close.

- By brand value, the hierarchy aligns but is not identical. Brand strength can sustain high valuation even in an average season.

- By profitability, a smaller but efficient organization with strong local deals can occasionally punch above its weight. The league’s cost control, especially the salary cap, keeps the business rational.

Owner profiles and what they mean for team finances

- Conglomerate-owned teams enjoy capital stability and cross-brand synergies that fill sponsor rosters faster.

- Media and entertainment ownership brings content leverage, talent access, and event production chops.

- Investment-firm ownership usually tightens governance, deploys analytics faster, and pushes global expansion smartly.

- Celebrity-led stakes provide unmatched PR and soft power that sponsors translate into brand lift.

A clean explanation of brand value vs revenue vs net worth in IPL

- Brand value: What the name is worth if licensed to a third party. An intangible, but with a methodology behind it.

- Revenue: What the team actually earns each season. Measurable, auditable, and the base for future valuation.

- Net worth or enterprise value: The price a rational buyer would pay for the franchise. Built on both brand value and revenue, then discounted for risk and weighted for growth.

Most valuable cricket franchise in a broader context

IPL teams dominate the cricket club valuation charts. On a global list of cricket entities by brand value and enterprise value, MI and CSK sit at the high end, with KKR and RCB not far behind. Compared with other domestic T20 leagues in the region, IPL franchises generally command multiples of both brand value and cash flow. The reason is a blend of media-rights scale, India’s advertising market depth, star power, and competitive balance that keeps broadcast windows dramatic.

IPL franchise value compared with global sports teams

Different sport, different economics. Football clubs often own stadiums and sign player contracts without a cap, leading to widely varying wage bills. American leagues lock in predictable revenue with long-term media contracts and revenue sharing. IPL sits somewhere in between: massive media rights, strong central revenue sharing, and a salary cap keep all teams healthy while allowing the most valuable IPL teams to separate through commercial sophistication.

What pushes a mid-tier franchise into the richest ipl team conversation

- Consistent playoff appearances. One good run lifts revenue. Sustained contention compounds brand value.

- Clear brand identity. Some teams are loved for swagger, others for grit, others for innovation. Prospects bloom when identity is coherent and repeated.

- Data and development edge. Smarter scouting and role definition produce undervalued contributors, freeing salary cap space to retain match-winners.

- Strategic sponsors. A few long-term partners that align deeply with the brand will out-punch a dozen rotating logos. Marketing integrations trump static placements.

- Community investment. Long-term school programs, local leagues, and regional content build an everyday relationship with fans that lives beyond two months a year.

A brief, digestible timeline of IPL brand value evolution without timestamping

- Foundation era. Celebrity ownership, metro glamour, and a brand-new T20 vocabulary set the stage. Early winners created myths.

- Consolidation. Sponsor education improved, team organizations professionalized, and media rights climbed. Valuers gained more comparable data.

- Professional maturity. Teams started behaving like sports-tech and media companies. Scouting labs, data analysts, and content studios moved in-house. Brand Finance and D&P models converged around a more stable premium for IPL teams.

- Modern surge. A fresh media-rights cycle rewired the top line, streaming deepened reach, and social commerce connected merch to moments. Enterprise values crossed symbolic thresholds.

Which team grew the most in brand value in recent seasons

The most striking risers have been the expansion teams, especially Gujarat Titans, which rode immediate sporting success into principal sponsor uplift and a big-market hospitality upside. Among legacy teams, KKR’s multi-club strategy and RCB’s relentless fan engagement have created valuation tailwinds even when results fluctuated. SRH’s smart recruitment resets and fresh coaching narratives have also delivered brand lift, while DC and RR have kept growth steady through youth-centric brand positioning.

Sponsorship revenue dynamics team by team

- MI enjoys tiered inventory with premium pricing; partner categories range from financial services and tech to global soft drinks and automotive.

- CSK’s sponsor pipeline is rich with FMCG and consumer-tech partners seeking mass resonance and trust cues.

- KKR balances brand associations spanning entertainment, fashion, and consumer durables, reinforced by celebrity-owned platforms.

- RCB skews toward tech, premium beverages, fintech, and e-commerce, leveraging a digitally native fanbase.

- GT and LSG have attracted ambitious new-economy brands wanting rapid awareness across North and West India.

- SRH brings regional leaders national exposure while anchoring national players in the South.

- DC, RR, and PBKS blend national brands with local champions, often focusing on experiential activations to maximize value.

Matchday revenue realities, city by city

- Mumbai and Bengaluru deliver per-seat pricing power that few others match, particularly in corporate sections.

- Chennai’s loyalty drives sellouts; demand stays high even through transition cycles.

- Kolkata’s massive fan base and emotional theatre produce consistent attendance and high sponsorship activation visibility.

- Ahmedabad’s scale and modern infrastructure unlock the most ambitious hospitality packages in the league.

- Hyderabad and Delhi bring balanced profiles: strong demand, good corporate uptake, and solid base rates.

- Jaipur, Mohali, and Lucknow rely on smart packaging and community embed to fill and thrill, often with excellent regional broadcasts as an amplifier.

The media business behind richest ipl team rankings

- Prime-time certainty. The IPL’s match windows are advertiser gold. Teams with larger star power tend to get the marquee slots more often, which sponsors value.

- Streaming scale. Digital platforms have changed how audiences watch cricket. Younger cohorts watch on phones, buy membership products, and engage with teams on reels and shorts. Teams that treat streaming as its own craft reap outsize attention.

- Sponsor integration. The prime spots on jerseys still matter, but shoulder, cap, and training kit inventory has captured sponsors looking for niche segments and repeats throughout broadcasts.

Brand strength pillars that correlate with valuation

- Icon consistency. A long-serving captain or batting star is the single strongest predictor of brand strength.

- Storytelling ability. Content production that feels like cinema, not advertising, turns casual watchers into community.

- Institutional calm. Sponsor renewals go smoother when the market senses stability. Calm shows up in retention decisions, contract structures, and public communication.

- Winning in style. Fans pardon the odd off-day when the brand stands for an aesthetic, whether it is power-hitting, relentless pace, or tactical guile.

The most profitable IPL team tends to look like this

- Strong base of central revenue plus outsized team sponsorships.

- Efficient salary cap usage, few sunk costs, and limited mid-season churn.

- Hospitality programs that sell out before the first ball is bowled.

- Merchandise and digital products that monetize superfans rather than chase vanity metrics.

Common misconceptions that drag the conversation

- Bigger auction purse equals richer franchise. The purse is regulated and identical.

- Owner net worth equals team net worth. Owner wealth helps, but valuation rides on media rights, sponsors, and brand equity.

- Titles automatically deliver top valuation. They help, but the brand engine matters more in the long run.

- All sponsorship inventory sells for similar rates. Position, category exclusivity, and team form change pricing dramatically.

Richest IPL team vs richest PSL team

The IPL’s commercial foundation—massive domestic market, premium ad rates, and global Indian diaspora—makes its teams significantly more valuable than PSL franchises on average. When comparing leaguewise brand value, IPL sits on a different curve. That does not discount the sporting quality or fan passion elsewhere; it just reflects current media economics.

IPL franchise value in the context of Asia’s most valuable sports teams

Among sports brands in Asia, top IPL franchises sit comfortably in the upper band. While football clubs with continental pedigree and baseball teams in certain markets hold legacy heft, Indian cricket’s unique blend of star power, media richness, and event culture puts MI and CSK in any serious list of Asian sports valuation leaders.

A closer look at enterprise value and what a buyer would pay

Three lenses guide serious buyers.

- Cash flow durability. How stable is the team’s revenue without a title push. MI and CSK ace this. KKR and RCB come close with their urban bases and sponsor depth.

- Upside capacity. New hospitality layers, untapped sponsor categories, and data monetization of fan bases expand upside. Newer teams like GT and LSG score high here.

- Risk control. Contract lengths for key sponsors, clarity in stadium agreements, governance quality, and depth in the cricket department reduce the discount rate in valuation models.

What investors, marketers, and fans should watch

- Growth of non-intrusive in-stadium advertising, such as LED ribbon boards and AR overlays during broadcasts.

- The next wave of categories: insuretech, health-tech, EVs, and sustainable consumer goods.

- Deep localization of content in multiple languages, which broadens sponsor pools.

- Use of fan data in refining pricing, renewals, and loyalty tiers.

The cleanest one-line answer on the richest IPL team

Mumbai Indians remains the most valuable IPL team by overall brand value in a consolidated view of authoritative sources, with Chennai Super Kings within a breath and superior on several brand strength metrics. The order can flip depending on methodology, but the summit is shared by these two superclubs.

A working glossary for serious readers

- Brand value: The discounted present value of the brand’s future earnings, measured via a notional royalty-rate method and adjusted for brand strength.

- Enterprise value: The total economic value of a franchise, including equity and debt, net of cash.

- Central pool revenue: League-level media rights and sponsor money shared with teams.

- Principal sponsor: The lead kit partner with the most prominent inventory placement.

- Hospitality ladder: Tiered matchday packages from premium seats to corporate boxes and suites.

A compact comparison of richest ipl team contenders by commercial signature

| Team | Commercial signature | Fan culture signal |

|---|---|---|

| MI | Corporate-grade polish, deep sponsor bench | Dynasty confidence |

| CSK | Trust-first storytelling, mass reach | Family-like devotion |

| KKR | Entertainment synergy, bold marketing | City pride with celebrity sparkle |

| RCB | Premium tech-forward positioning | Loyal urban ultras |

| GT | New-market power, modern packaging | Calm competence |

| SRH | Balanced, value-driven deals | Local heroes, disciplined cricket |

| DC | Youthful, metro-professional | Stylish, progressive |

| RR | Innovation halo, smart partnerships | Tactics lovers, scouting pride |

| LSG | Family-friendly, FMCG-heavy | Inclusive, upbeat |

| PBKS | Energy-led, flexible deals | Colorful, expressive |

Sustainability and governance, the silent drivers of value

- Environmental considerations. Franchises are investing in waste reduction at stadiums, water conservation, and sustainable merchandise. Sponsors increasingly look for credible ESG alignment.

- Governance frameworks. Clear lines between cricket operations and commercial teams, robust compliance, and transparent accounting improve investor confidence and valuation stability.

- Community legacy. CSR programs tied to cricket education, girl-child participation, and grassroots infrastructure pay goodwill dividends that show up in brand surveys.

Content is currency in the offseason

The teams that hold attention between tournaments grow valuation faster. Long-form documentaries, candid player diaries, regional-language series, and creator collaborations sustain relevance and sponsor value. MI, CSK, KKR, and RCB have built in-house media machines. RR and DC punch above their weight with clever formats and analytics storytelling. GT and LSG, despite being younger, already show a strong content identity.

Merchandising that works in India’s cricket culture

- Lightweight, climate-sensitive jerseys with daily-wear appeal.

- Regional designs that respect local aesthetics.

- Limited-run collaborations with streetwear and sneaker communities.

- Smart pricing with entry-level tees and premium player editions.

A final synthesis for fans and decision-makers

- The richest team in IPL terms points to brand value, not owner wealth or salary purse. Use that definition and the picture becomes clear.

- Mumbai Indians and Chennai Super Kings are the league’s valuation superclubs. One leads on absolute brand value more often; the other dominates brand strength. Both anchor the top tier.

- Kolkata Knight Riders and Royal Challengers Bengaluru form a powerful second ring, with Gujarat Titans emerging rapidly thanks to a big market and early success.

- Sunrisers Hyderabad, Delhi Capitals, Rajasthan Royals, Lucknow Super Giants, and Punjab Kings are in a fierce contest to convert loyal local followings into higher sponsor rates and hospitality yield.

- Media-rights scale and a steadily professionalizing ecosystem mean the floor has risen for everyone. The gap at the top persists because systems, not seasons, drive valuation over time.

Richest IPL team is a moving title, but not an unstable one. In a league designed for competitive balance, the richest labels still follow those who marry institutional calm with relentless learning. Think of MI’s corporate precision and global reach. Think of CSK’s unshakable trust and cultural gravity. The rest are not chasing a myth; they are catching a train that runs on discipline, data, and detail. And that, in truth, is what keeps this carnival a world-class business as much as it is a world-class spectacle.

Zahir, the prolific author behind the cricket match predictions blog on our article site, is a seasoned cricket enthusiast and a seasoned sports analyst with an unwavering passion for the game. With a deep understanding of cricketing statistics, player dynamics, and match strategies, Zahir has honed his expertise over years of following the sport closely.

His insightful articles are not only a testament to his knowledge but also a valuable resource for cricket fans and bettors seeking informed predictions and analysis. Zahir’s commitment to delivering accurate forecasts and engaging content makes him an indispensable contributor to our platform, keeping readers well informed and entertained throughout the cricketing season.