Opening summary and the straight answer

Among Indian cricketers, the crown for overall wealth sits with Sachin Tendulkar. On conservative estimates built from public contracts, long-running endorsements, equity deals, and business holdings, the Little Master’s cumulative wealth lands in the ₹1,400–1,600 crore band. Close behind are Virat Kohli and MS Dhoni, both in the ₹900–1,200 crore corridor depending on how one marks private investments, prevailing valuations of athleisure and consumer brands, and real estate. The richest active Indian cricketer by annual earnings trends toward Virat Kohli, driven by unmatched brand value, a premium endorsement rate, and a deep portfolio of equity-linked brand partnerships. The highest cumulative earner from IPL salaries alone has been Virat Kohli, with MS Dhoni and Rohit Sharma neck and neck in the next slots.

This piece lays out a transparent methodology built from the way we value athletes in sports business desks, then ranks India’s richest cricketers with sourced logic rather than headline-chasing numbers. Along the way, it unpacks how money actually flows in cricket in India — BCCI contracts, IPL salaries and retentions, match fees, endorsements, appearance income, business equity, and long-tail assets like pensions and commentary. If you read this from start to finish, the phrase richest cricketer in India will never feel like a guess again.

Top richest Indian cricketers: ranked list with net worth ranges and primary drivers

These ranges are estimates, not absolutes. They synthesize disclosed salaries, IPL earnings, publicly known deal sizes, credible brand valuation studies, company filings where accessible, and reasonable assumptions on taxes and expenses. The ordering reflects overall net worth rather than a single-season income spike.

| Name | Estimated Net Worth (₹ crore) | Primary Drivers | Active or Retired |

|---|---|---|---|

| Sachin Tendulkar | 1,400–1,600 | Legacy endorsements, equity in brands, sports team stakes, long-tail royalties, real estate | Retired |

| Virat Kohli | 1,000–1,200 | Endorsements at premium rates, One8 x Puma, Wrogn, equity in consumer and tech brands, IPL earnings | Active |

| MS Dhoni | 850–1,050 | Endorsements, Seven lifestyle brand stake, team ownership, IPL earnings, endorsements with equity | Active |

| Sourav Ganguly | 400–650 | Endorsements, administration roles over time, TV, equity deals, real estate | Retired |

| Kapil Dev | 250–450 | Businesses, hospitality, endorsements, investments, media | Retired |

| Virender Sehwag | 250–300 | Commentary and media, endorsements, ventures in education and digital, real estate | Retired |

| Rohit Sharma | 250–350 | Endorsements, IPL earnings, equity tie-ups, BCCI A+ contracts | Active |

| Rahul Dravid | 180–250 | Coaching contracts, commentary history, endorsements, investments | Retired player, active coach |

| Yuvraj Singh | 220–300 | Endorsements, venture investments, IPL career earnings, brand-led initiatives | Retired |

| Sunil Gavaskar | 200–300 | Commentary, endorsements, writing royalties, legacy brand value | Retired |

| Suresh Raina | 180–240 | IPL earnings, endorsements, TV, entrepreneurship | Retired |

| Ravindra Jadeja | 110–150 | BCCI contracts, IPL earnings, endorsements, real estate | Active |

| R Ashwin | 110–150 | BCCI contracts, IPL earnings, endorsements, content IP | Active |

| Jasprit Bumrah | 110–140 | BCCI contracts, IPL earnings, premium endorsements | Active |

| Shikhar Dhawan | 110–150 | Endorsements, IPL earnings, entrepreneurship | Active |

| KL Rahul | 100–150 | Endorsements, IPL earnings, equity stakes in lifestyle brands | Active |

| Rishabh Pant | 90–120 | Endorsements, IPL earnings, BCCI contracts | Active |

| Suryakumar Yadav | 70–110 | Endorsements, IPL earnings, rising equity deals | Active |

| Shubman Gill | 50–90 | Endorsements, IPL earnings, early-stage equity tie-ups | Active |

| Anil Kumble | 90–140 | Coaching and administration roles, endorsements, investments | Retired |

The exact order shifts at the margins because private equity and real estate valuations are opaque. The top three are clear and stable, though the gap between Kohli and Dhoni continues to breathe with each big endorsement renewal, and Rohit’s long captaincy stretch has widened his lead over the chasing pack.

Methodology: how this ranking is built and why it avoids fantasy numbers

In sports business reporting, credible wealth estimates come from a spine of hard data, layered with reasoned assumptions. Here is the consistent framework used across this analysis.

- BCCI central contracts: Retainer bands for A+, A, B, and C contracts are public. These retainers combine with per-match fees for Test, ODI, and T20I. Current match fees widely referenced in official and media releases: Test ₹15 lakh, ODI ₹6 lakh, T20I ₹3 lakh. Retainer bands are ₹7 crore for A+, ₹5 crore for A, ₹3 crore for B, ₹1 crore for C. Only contracted players receive these retainers in a given cycle.

- IPL salaries: Player salaries come from auction results or franchise retention announcements. Fixed retainer for the season, pro-rated in case of mid-season replacements; full salary generally paid irrespective of playing XI appearances. Cumulative IPL earnings are tracked season-on-season and are a reliable backbone for career earnings. Kohli, Dhoni, and Rohit lead in cumulative IPL salary.

- Endorsements and appearances: Rates are triangulated from brand and agency disclosures, media coverage, and category norms. A-list cricketer endorsement fees in India range from roughly ₹1–3 crore per day for top captains and batters, scaling up to the mid to high single digits for outliers like Kohli for multi-asset deliverables. Fees vary by category exclusivity, social deliverables, term length, and equity sweeteners. For Dhoni and Rohit, fees often sit in a healthy premium band; for rising stars, fees step up sharply after big tournament impact.

- Equity and businesses: This is the most under-reported component. We consider visible equity stakes in athleisure labels, consumer products, food-tech, fitness chains, and team ownerships. Where valuations are private, we assign conservative bands based on comparable transactions or revenue run rates. For Sachin, Kohli, and Dhoni, this line often outstrips salary income over time.

- Media and commentary: For retired legends, commentary, punditry, coaching, and administration add meaningful income. High-profile commentators can command strong per-day fees through international seasons and T20 leagues, further diversified with brand work.

- Taxes and costs: Indian top-bracket tax rates, surcharges, and GST implications on services apply. Agent commissions often range from 10–20 percent on endorsements. Travel, staff, training, and philanthropy are real line items. The ranges quoted here are post these structural realities to the extent one can generalize on publicly available evidence.

- Currency and inflation: Estimates are maintained in INR to avoid foreign exchange noise. Where historical earnings are involved, we consider the effect of compounding investment returns rather than mechanistically summing nominal incomes.

- Cross-checks: We cross-reference BCCI releases, IPL press notes, leading business media coverage, filings on the Ministry of Corporate Affairs portal for key entities, Kroll’s athlete brand valuation notes, and long-form interviews on business holdings.

With this methodology, one big myth clears quickly. The richest Indian cricketer is rarely the highest paid in one single season. Sustained post-retirement value, smart equity, and compounding turn great players into great portfolios.

Deep dives: how India’s richest cricketers actually built their wealth

Sachin Tendulkar — the enduring wealth of a national icon

The story of Sachin’s wealth illustrates what happens when a brand outlives the career and runs on trust. His endorsement ledger has included automotive, finance, FMCG, and technology across decades. Tendulkar’s playbook evolved from classic above-the-line endorsements to high-trust category presences with quasi-ambassadorial longevity. Two strategic levers pushed his net worth into the top band.

- Equity and royalties: Legacy deals that included equity or royalty components continue to pay out as long-tail cash flows. The Little Master learned early that a small slice of a growing consumer brand beats a short blare of cash. His investments in technology and sports-adjacent ventures, plus past stakes in franchise sports, underpin the long end of his curve.

- Real estate and careful diversification: From premium residential holdings to commercial spaces associated with brand activity, property works as ballast. Conservative asset allocation amplified compounding without dramatic risk.

The marker that sports business people look for is this — the brand strength holds across generations. Children who never saw his peak still recognize him as the gold standard of Indian batting. That recall is wealth in slow motion.

Virat Kohli — modern athlete enterprise at full throttle

Virat operates in a completely different commercial era, and his brand machine sits at the cutting edge. He tops India’s athlete brand value lists, commands a leadership endorsement fee, and runs an ecosystem rather than a set of deals.

- One8 and Puma: The One8 label under the Puma partnership is an instructive blueprint. It blends signature apparel and footwear, event moments, and a retail footprint tied to the Kohli persona. The commercial engine throws off both cash and brand equity. It is an asset, not a cheque stub.

- Wrogn and lifestyle stakes: Fashion and athleisure suit his audience. Equity in youth-first consumer brands captures the upside of every ad he shoots. He does not only sell for a fee; he sells for a piece.

- Tech and food: Select investments in plant-based foods, wellness tech, and D2C brands add optionality. Some deliver near-term returns through ambassador contracts; others are long bets seeking scale effects.

- IPL and BCCI income: Add long tenure on the top rung of BCCI retainers and one of the highest cumulative IPL salary totals. Match fees matter less than endorsements in Virat’s universe, but those retainers are a reliable floor.

The fine print is operational excellence. Kohli’s team manages frequency, category conflicts, and social content so his face never looks overexposed. That keeps endorsement rates premium and conversion high.

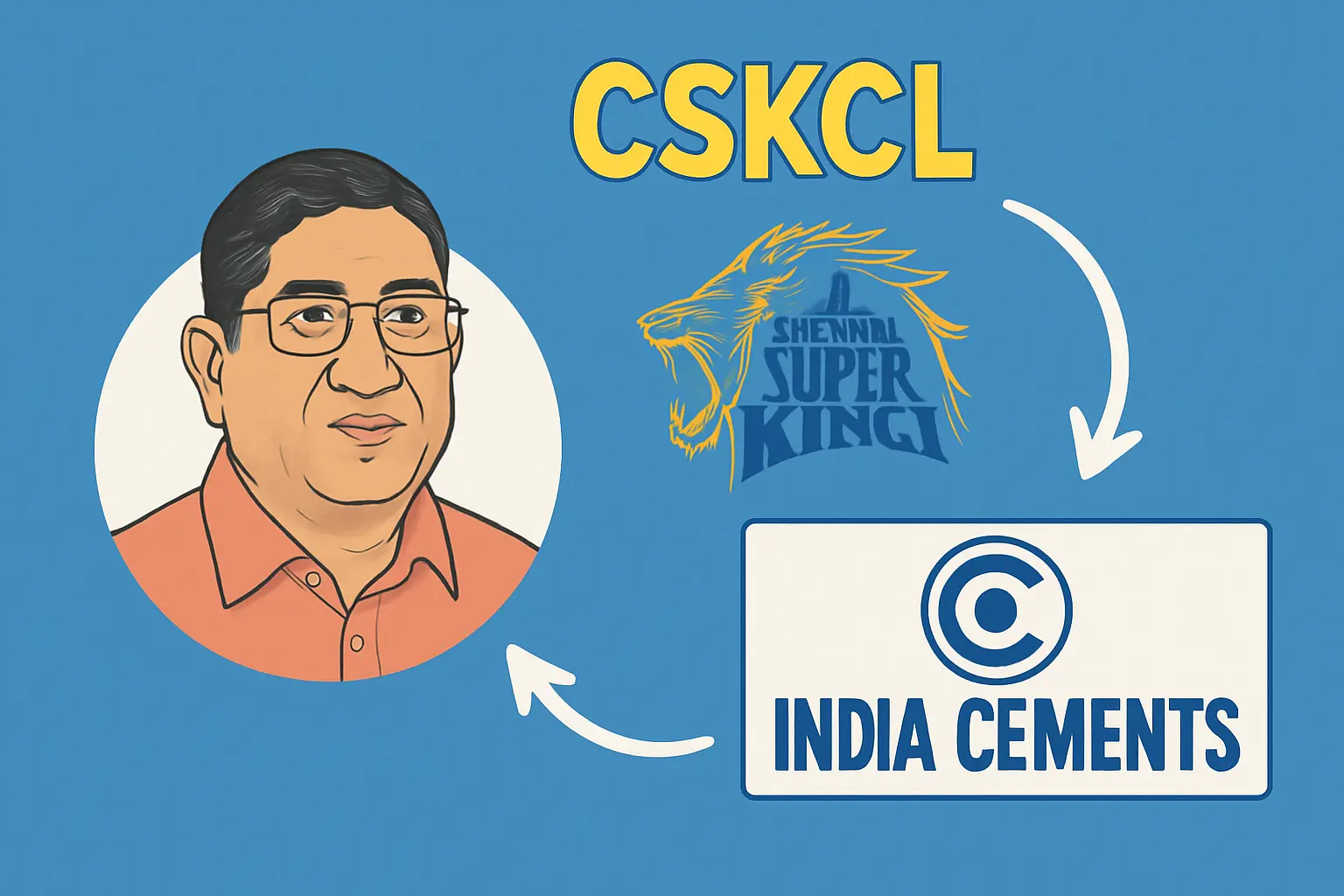

MS Dhoni — trust as a currency and the compounding power of Seven

Dhoni’s brand arc has uncommon depth. A generation knows him as a finisher and a World Cup-winning captain. Another knows him as the calm in a yellow jersey. Commercially, he built around trust, consistency, and category breadth.

- Seven by MS Dhoni: The Seven brand is more than a signature line. His stake aligns him with the P&L of an athleisure play in a market that adores cricket. Even as templates change, Seven keeps him in the conversation as an owner-operator, not just a face.

- Endorsements at scale: Dhoni signs for a diverse stack, from FMCG and fintech to oil and paints, often with multi-year comfort. His presence stabilizes campaigns in smaller cities and tier two markets where mass trust can trump cutting-edge aesthetic.

- Team ownership and sports ventures: Equity in franchise sports and partnerships in training and grassroots initiatives keep cash flows running. He also benefits from one of the most enduring fandoms in the IPL, which shows up in merchandise and eyeballs.

- IPL salary and match retainers: Long years at the very top end of IPL and BCCI income provide safe ballast. Add to that appearance fees that work because he rarely misses.

Dhoni’s edge is the absence of scandal, drama, or inconsistency. In brand rooms, that converts into one more year on the contract and one less discount on the rate card.

Rohit’s portfolio matured as he grew into a leader. He sits in the upper band of BCCI retainers and commands robust endorsement rates across categories like fintech, consumer tech, gaming, FMCG, eyewear, and lifestyle.

- Captaincy dividend: Leading the national team and a storied IPL side created a gravitas that pushed deal flow from mid-tier to top-tier. Leadership is a product, and brands buy it for launches and credibility.

- IPL economics: Long stints with a big-market franchise mean steady salary and postseason brand work that taps fan bases beyond cricket’s usual core.

- Equity deals: Select stakes in consumer and performance brands bolster long-term value. He is more selective than expansive, which helps maintain brand fit.

Hardik Pandya — entertainment factor with all-format upside

Hardik’s monetization rides on high visibility and a crossover audience. Variety shows, digital content, and fashion-forward positioning opened categories that were once closed to Indian all-rounders.

- Endorsements: A deep roster in beverages, athleisure, and accessories. Rates stepped up with captaincy spells and performances in white-ball cricket.

- IPL deals: A premium price point in the franchise market positioned him among the highest earners in limited-overs seasons. He thrives in high-spotlight fixtures which brands love.

- Lifestyle equity: Exposure to fashion and entertainment unlocks premium lifestyle collaborations, especially limited drops and collab capsules.

Rahul’s brand map favors fashion, grooming, watches, and premium consumer tech. He is a marketer’s neat fit for higher-ASP products targeting urban audiences.

- Endorsements: Solid mid-to-top tier rates with clean brand fit. Known for immaculate styling, which keeps fashion and grooming categories sticky.

- IPL and BCCI: Premium IPL contract and top retainer bands for several cycles anchor annual income.

Ravindra Jadeja and R Ashwin — specialists with durable value

Both command respect, television time, and social conversation, which keep them relevant to brands and broadcasters.

- Jadeja: A category bridge between mass-market, south and west India audiences, and devotion in Test and IPL. Endorsements across consumer goods and agricultural-adjacent categories are an underrated thread.

- Ashwin: Intellectual spin brand with content IP, thoughtful YouTube play, and multi-language approach. The content flywheel translates into stable endorsement work beyond purely performance-driven cycles.

Bumrah’s rise reshaped fast bowling in Indian cricket and gave brands a performance billboard. His clean brand profile, no-nonsense manner, and big-match record keep rates high and conflicts controllable. Edgier sports tech, fintech, and performance nutrition like to line up behind him.

Shikhar Dhawan — charm, media presence, and entrepreneurship

Shikhar thrives beyond the field with a disarming media persona, real cohesion with family-friendly content, and deep resonance in the north. Endorsements and entrepreneurial moves add up to a stable, diversified portfolio.

Rishabh Pant — resilient star power

Pant’s brand momentum surged with match-winning knocks and the raw energy that television loves. Post-recovery narratives have enhanced his mass goodwill. He remains a top endorsement magnet for youth-facing categories.

Suryakumar Yadav and Shubman Gill — the now and the next

- Surya: The batting lab of T20 brand identity. Power with innovation pairs well with tech, energy drinks, and gaming. Rates rose in step with ranking metrics and signature shots that look great on screen.

- Gill: The golden-boy arc with crossover fashion value. Early equity stakes in consumer digital brands set him up for long-term gains.

Retired legends with durable media engines

- Sourav Ganguly: Boardroom experience, television, and a lifetime of leadership aura feed a premium endorsement funnel. Add real estate and advisory roles.

- Rahul Dravid: The quiet strong brand that advertisers love for credibility. Coaching contracts deliver steady income, while high-trust categories return to him when they need reassurance.

- Kapil Dev, Sunil Gavaskar, Virender Sehwag, Anil Kumble: Each blends commentary, endorsements, and investments. Gavaskar’s commentary calendar alone would be a healthy standalone business. Sehwag’s digital voice print is a moat.

Highest paid IPL player versus richest Indian cricketer

In franchise cricket discourse, highest paid IPL player often gets conflated with richest cricketer in India. They are different conversations.

- Highest paid in IPL in a given season refers to the top auction or retention salary line. Foreign quicks have set headline records in recent auctions. Among Indians, retentions and marquee auction buys have touched the mid to high teens in crores per season.

- Cumulative IPL salary career totals put Virat Kohli at the top among Indians, with MS Dhoni and Rohit Sharma close behind. This is a hard-number metric one can check season by season.

- Richest Indian cricketer overall factors in endorsements, equity stakes, media, and investments. This crown sits with Sachin Tendulkar because of compounding and asset allocation over decades, not the single-season shock of a mega-contract.

BCCI contracts and match fees explained

Every long debate about richest Indian cricketer eventually ends at the same question of fixed income from the board. The mechanics are straightforward and public.

-

Central contract retainers:

- Grade A+ retainer at ₹7 crore

- Grade A retainer at ₹5 crore

- Grade B retainer at ₹3 crore

- Grade C retainer at ₹1 crore

-

International match fees per match:

- Test at ₹15 lakh

- ODI at ₹6 lakh

- T20I at ₹3 lakh

- Domestic and red-ball incentives: The board has stepped up Test cricket incentives and domestic match fees in recent seasons to reward longer formats. This matters to players outside the top endorsement tiers, stabilizing annual income.

- Pension and benefits: Retired Indian cricketers receive pensions based on matches played and era, with revised slabs announced periodically. Medical benefits, insurance, and domestic appearance fees create a safety net that few other sports in India match.

In wealth terms, BCCI income stabilizes the base and buys time to be selective with endorsements. It rarely determines the ceiling for top-tier stars who may earn multiple times the retainer on a single multi-brand shoot day.

Endorsements and brand value in India’s cricket economy

Brand value decisions in India are emotional, data-driven, and increasingly social first. Here is how the economics look for headline athletes.

- The fee ladder: Top-of-the-pyramid Indian cricketers clear ₹1–3 crore per day routinely. Outliers with unrivaled brand value like Virat Kohli can step into the high single digits for integrated deals with content, events, and long-term partnerships. MS Dhoni and Rohit Sharma occupy the proven-premium rung with multi-category depth.

- Categories that pay: Financial services, e-commerce, fantasy and gaming, beverages, smartphones, FMCG, automotive, paints, and ed-tech have historically been most aggressive. Consumer tech and D2C wellness have added new momentum. Athleisure pays differently through equity and revenue share.

- Equity over cash: Athletes at the top now prefer blended deals. A smaller cash retainer plus a meaningful equity stake creates a strong alignment with brand growth. This is where wealth accelerates and why the richest cricketer in India conversation should always include brand cap tables.

- Social and content: Owned content IP increases bargaining power. Ashwin’s thoughtful channels, Sehwag’s humor, Pant’s behind-the-scenes approach, and Kohli’s well-lit, fitness-forward posts are not vanity projects. They reduce dependence on broadcaster cuts and lend leverage in rate cards.

Businesses and investments: the quiet compounding machine

A few patterns repeat among India’s wealthiest cricketers.

- Athleisure and lifestyle: Kohli’s One8 x Puma and Wrogn, Dhoni’s Seven, and Sachin’s long-tail lifestyle presences prove the category’s logical fit. It speaks to daily life, not just sport. Margins and growth make equity valuable.

- Sports franchises and academies: Ownership or stakes in football, badminton, and other leagues, plus grassroots academies, allow brand monetization beyond personal playing days. Sachin’s ISL involvement and Dhoni’s franchise ties are instructive examples.

- Tech and D2C: From plant-based protein and wellness recovery to mobile gaming and consumer electronics, Indian cricketers show up early in cap tables. Some bets are pure endorsement-for-equity, others require follow-on capital and board attention.

- Hospitality and real estate: A reliable ballast. Hotels, restaurants, and commercial properties can be volatile in the short term but anchor wealth over cycles. Legends like Kapil Dev and Sachin used real estate when it was relatively less crowded by celebrity money.

- Media and IP: Books, documentaries, docu-series, and training content create annuity streams and negotiating leverage. The most valuable long-term media asset remains credibility, which cannot be purchased.

Taxes, costs, and commonly misunderstood realities

- Taxes bite: Top-bracket income in India sits under high marginal rates with surcharges. GST can apply to endorsement services. Short-term capital gains, long-term capital gains, and dividend taxation matter to equity-rich athletes. What looks like ₹10 crore gross in a headline may effectively be half that after taxes and commissions.

- Agents and teams: The best-managed athletes run with professional managers, PR, legal counsel, fitness and medical teams, and security where required. This supports career longevity and better deals but adds cost.

- Cross-border income: Several cricketers earn internationally through endorsements or global campaigns. Double tax avoidance agreements and withholding complexities require sophisticated planning.

- Lifespan management: Earnings volatility between peak form and off seasons is real. The wisest portfolios are built for variance. Kohli’s, Dhoni’s, and Sachin’s models reflect this learning.

India versus the world: where Indian cricketers stand globally

Global richest lists often feature franchise owners, golfers with enormous prize purses and endorsements, tennis icons, and NBA and football superstars with gigantic guaranteed salaries. In cricket, franchise salaries are meaningful but only a slice of the global sports wage pie. Indian cricketers catch up through the sheer scale of endorsements in the home market and the ability to move merchandise and content. Among cricketers globally, Virat Kohli consistently leads in annual endorsement income, while Sachin Tendulkar often sits on top in cumulative net worth courtesy of time in the market and prudent asset allocation. In absolute global sport wealth rankings, Indian cricket edges into the conversation on the back of brand value, not salaries alone.

Richest IPL cricketer versus richest Indian cricketer

- Richest IPL cricketer as a career earner from the league’s salary files is Virat Kohli, with MS Dhoni and Rohit Sharma close. These totals are public record season by season.

- Richest Indian cricketer overall remains Sachin Tendulkar because the IPL does not exist in a vacuum. Endorsements plus equity and real estate matter more than a single line item on a contract.

Per match salary of Indian cricketers and how the money stacks up

- Test match fee at ₹15 lakh is generous by cricket standards and reflects the board’s attempt to protect red-ball cricket’s prestige. For a first-choice Test player playing a full cycle, match fees alone can cross crores without endorsements.

- ODI and T20I match fees at ₹6 lakh and ₹3 lakh respectively provide stable cash flow but pale next to top-tier endorsement days.

- For A+ contracted players, add a ₹7 crore retainer before any match is played. Even Grade A at ₹5 crore and Grade B at ₹3 crore build a comfortable base.

- IPL salary for top Indians hovers in the high single digits to low teens in crores per season. This can exceed the annual BCCI retainer but is not a substitute for endorsements and equity when wealth is the target.

State taxes on IPL income do not apply the way many imagine. Cricketers are taxed based on residency and national income tax laws, not city-based levies, though GST and TDS mechanics show up in how payments are processed.

Hindi summary for reach and clarity

भारत का सबसे अमीर क्रिकेटर — यह खिताब सचिन तेंदुलकर के पास सुरक्षित बैठा है. विश्वसनीय अनुमानों के मुताबिक उनकी कुल संपत्ति का दायरा लगभग ₹1,400–1,600 करोड़ में आता है. विराट कोहली और एमएस धोनी अगली पंक्ति में हैं. वार्षिक कमाई के लिहाज से विराट सबसे आगे, क्योंकि ब्रांड वैल्यू, एंडोर्समेंट फीस और इक्विटी डील्स का असर जोड़कर देखना पड़ता है. आईपीएल वेतन के मामले में करियर कमाई के हिसाब से विराट आगे, जबकि कुल संपत्ति में सचिन की पकड़ सबसे मजबूत बनी हुई है.

Long-view comparisons that matter

-

Virat Kohli versus MS Dhoni wealth comparison

- Annual income tilt favors Kohli through premium endorsements and lifestyle equity.

- Total wealth gap is narrower because Dhoni retains a massive endorsement base, a personal brand with deep tier two and three city resonance, and equity via Seven and franchise ties.

- Market cycles push the needle for Kohli faster, while Dhoni’s graph is steadier.

-

Sachin Tendulkar versus Virat Kohli net worth comparison

- Sachin’s compounding advantage, real estate ballast, and legacy brand power sustain a lead.

- Kohli’s growth rate is higher in peak years due to scale of endorsements and brand enterprise, gradually closing the gap but still short on cumulative compounding.

-

Richest active Indian cricketer nudge

- On raw annualized earning potential, Kohli leads. Long-term wealth retention depends on how equity continues to appreciate and the discipline of reinvestment.

What moves rankings more than fans think

- New equity deals or liquidity events: A brand buyout, a secondary sale, or a major valuation step-up can add nine figures overnight in INR terms.

- Big captaincy or tournament arcs: A dominant season, an iconic knock, or a trophy raises rate cards immediately. The bump lasts longer if it lands on an already strong brand base.

- Media control: Launching a content studio, docu-series, or bilingual channels that travel well compounds influence and makes negotiation tables tilt.

- Administration and coaching roles: For retired players, a national coaching contract or a prominent administrative chair reopens premium endorsements.

- Off-field reputation: A scandal can deflate rates for multiple cycles. India buys trust, and trust is monetized.

Practical calculator logic for estimating a cricketer’s net worth

A simplified estimator that mirrors the logic used here:

-

Annual base:

- BCCI Retainer + estimated match fees based on format load

- IPL salary

- Endorsements and appearances net of agency fees

- Commentary or coaching if applicable

-

Asset gains:

- Change in value of equity stakes using conservative growth assumptions

- Rental and yield income on real estate

- Royalties and residuals from books or licensed IP

-

Less:

- Taxes and surcharges at current slabs

- Operating costs for management, training, travel, and compliance

Repeat this for a rolling five-year window, apply a compounding assumption for private holdings, and add legacy assets for retired legends. Then triangulate with known disclosures and reputable coverage. The range you land in will be close to what this ranking presents.

Common myths busted

- Highest IPL bid does not equal the richest Indian cricketer. It is one season’s wage, not a balance sheet.

- One mega endorsement does not guarantee durable wealth. Equity and reinvestment do that.

- Sports administration roles are not just salaries. They generate credibility that spills into long-lived brand work.

- Commentary is not small money for legends. A full broadcast calendar plus brand work equals a strong annual income.

Key takeaways to remember

- The richest cricketer in India is Sachin Tendulkar, followed by Virat Kohli and MS Dhoni. The difference is not a single-season phenomenon but decades of brand value and patient investing.

- Virat Kohli leads as the highest brand value Indian cricketer today and is the richest active Indian cricketer by annualized income, with Kohli also topping cumulative IPL salary earnings.

- The decisive component in wealth is equity plus endorsements, not the BCCI salary, which serves as a reliable base.

- IPL salary headlines are thrilling, but endorsements and compounding create enduring wealth. The personal balance sheet grows when cricketers own rather than only endorse.

- Rankings shift around equity events, new multi-year deals, and leadership arcs. The top three remain stable because of diversified portfolios.

Richest Indian cricketers right now: a focused list with context

To close with clarity, here is a concise leaderboard framed in INR ranges and context that explains the rank more than any one headline can.

Sachin Tendulkar — ₹1,400–1,600 crore

A brand with intergenerational trust, prudent equity, and real estate ballast. Enduring royalty and high-quality legacy deals keep compounding.

Virat Kohli — ₹1,000–1,200 crore

India’s strongest athlete brand value, premium endorsements, own labels, and high cumulative IPL earnings. Equity in consumer and tech brands drives upside.

MS Dhoni — ₹850–1,050 crore

The most broadly trusted mass-market athlete brand, a lifestyle label with skin in the game, and enormous IPL and endorsement longevity.

Sourav Ganguly — ₹400–650 crore

Administration aura, TV presence, and North-East India visibility with endorsements and real estate.

Kapil Dev — ₹250–450 crore

Business ventures and legacy endorser status with hospitality and investments through cycles.

Virender Sehwag — ₹250–300 crore

Digital-first reach, commentary income, endorsements, and ventures in education and media.

Rohit Sharma — ₹250–350 crore

Captaincy dividend, premium endorsements, and solid equity stakes plus top-tier IPL earnings.

Sunil Gavaskar — ₹200–300 crore

Commentary and media powerhouse with long-lived credibility and royalties.

Yuvraj Singh — ₹220–300 crore

Iconic tournament legacy, endorsements, and venture investments, with social goodwill translating into brand equity.

Rahul Dravid — ₹180–250 crore

Coaching income at the national apex, credibility-driven brand work, and prudent investments.

The next cluster includes Suresh Raina, Ravindra Jadeja, R Ashwin, Jasprit Bumrah, Shikhar Dhawan, KL Rahul, and Rishabh Pant, followed by Suryakumar Yadav and Shubman Gill whose curves are steep and rising.

Sources and data spine

- BCCI central contracts and match fee announcements published on official BCCI channels and mirrored by leading sports media

- IPL auction and retention disclosures via franchise statements, IPL’s official website, and ESPNcricinfo auction trackers

- Brand valuation studies by Kroll for athlete brand value in India

- Forbes India Celebrity lists and sectoral features on athlete earnings

- Ministry of Corporate Affairs filings for companies linked to athlete brands and ventures

- Interviews and long-form profiles in The Economic Times, Mint, Business Today, and national broadcasters that detail investments, startups, and brand philosophy

- Franchise financial reporting and credible media analysis for cumulative IPL salary rankings

Closing perspective

Cricket in India is a financial ecosystem now. The richest cricketer in India is no longer just a tally of match fees and a dozen television commercials. It is a story about equity, discipline, trust, and the ability to stand for something that outlives a career. Sachin’s long shadow reflects compounding on a patient base. Kohli’s machine reflects a modern content and commerce engine in overdrive. Dhoni’s curve reflects trust monetized with rare consistency. Everyone else who rises close to them borrows a page from one of these playbooks.

For fans, this is good news. The game’s heroes are not only breaking records on the field. They are building companies, investing in ideas, and backing communities in ways that give cricket a wider life. Wealth created that way is resilient. It makes the phrase wealthiest Indian cricketer less about a headline and more about a blueprint others can learn from.

Zahir, the prolific author behind the cricket match predictions blog on our article site, is a seasoned cricket enthusiast and a seasoned sports analyst with an unwavering passion for the game. With a deep understanding of cricketing statistics, player dynamics, and match strategies, Zahir has honed his expertise over years of following the sport closely.

His insightful articles are not only a testament to his knowledge but also a valuable resource for cricket fans and bettors seeking informed predictions and analysis. Zahir’s commitment to delivering accurate forecasts and engaging content makes him an indispensable contributor to our platform, keeping readers well informed and entertained throughout the cricketing season.